Log in to the Merchant Account Assigned by xCurrency Hubs

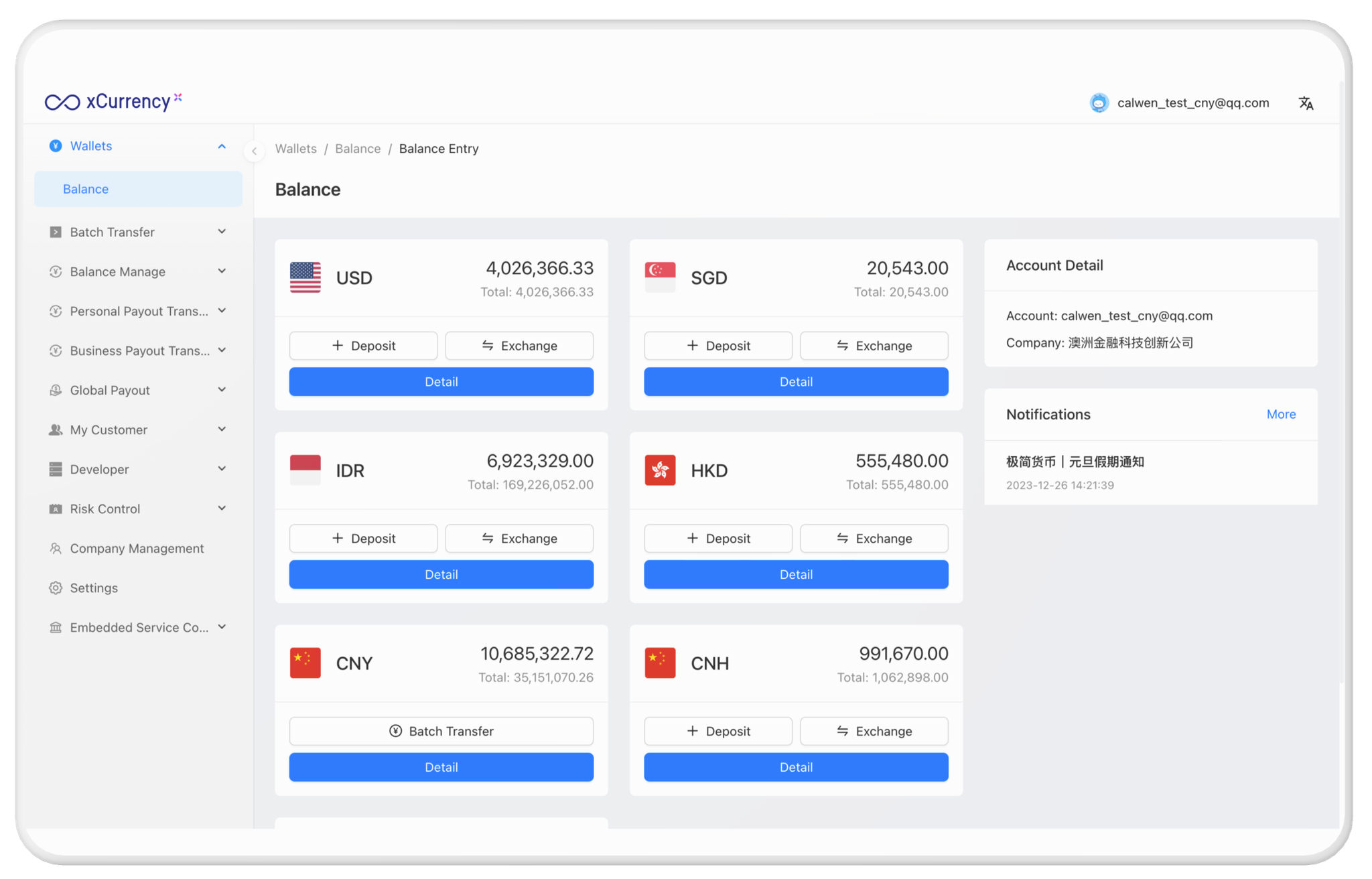

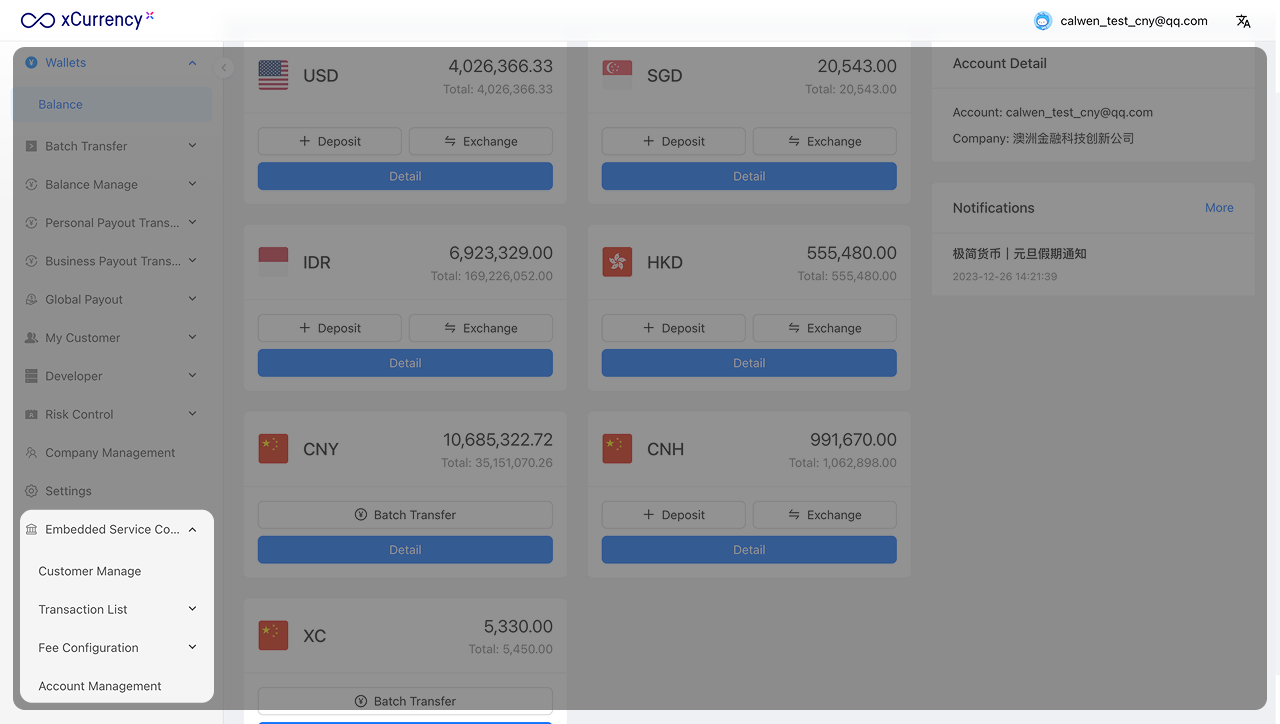

You need to manage your Embedded Service Counter functions under the Terminal Remittance Product module.

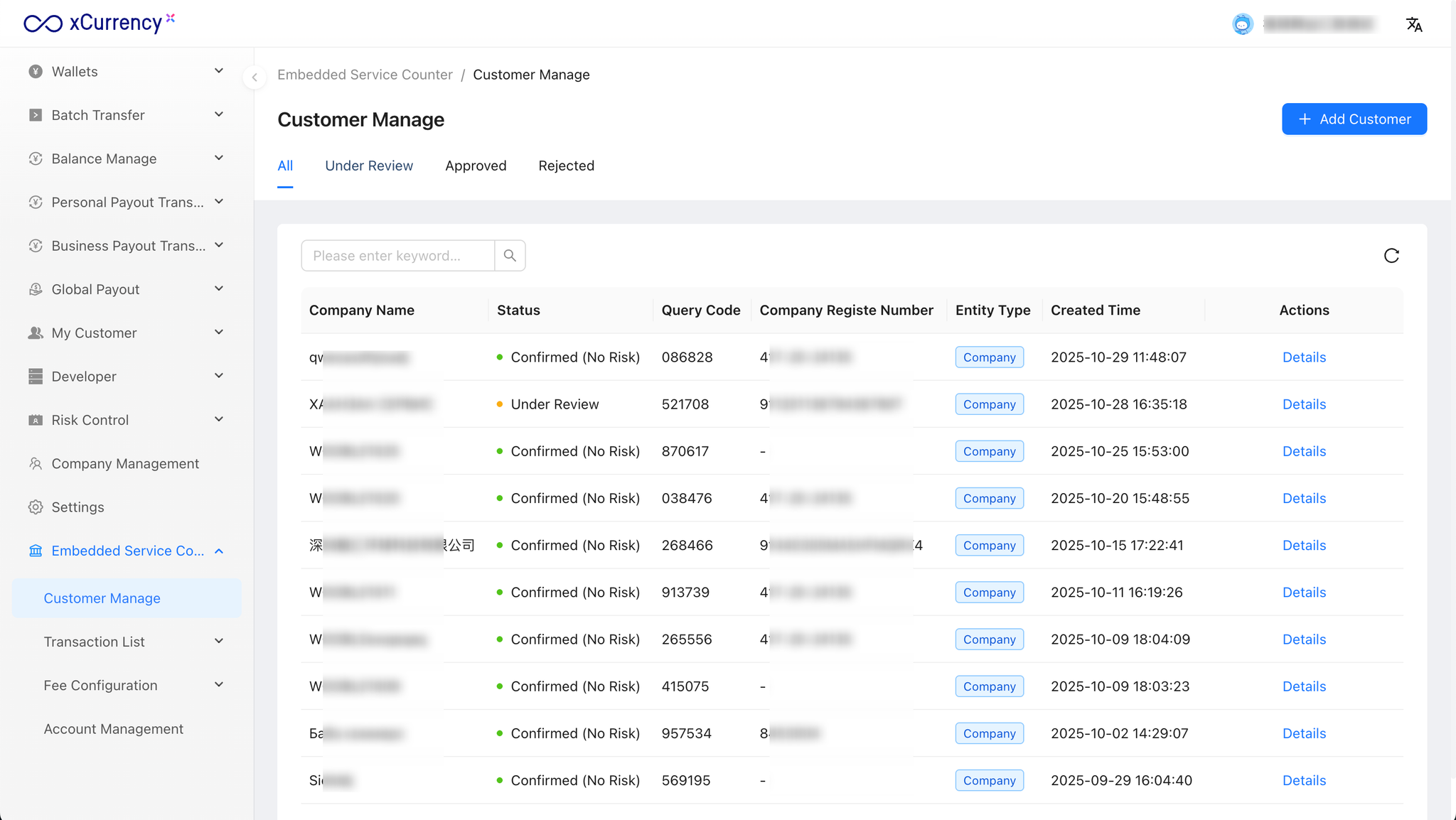

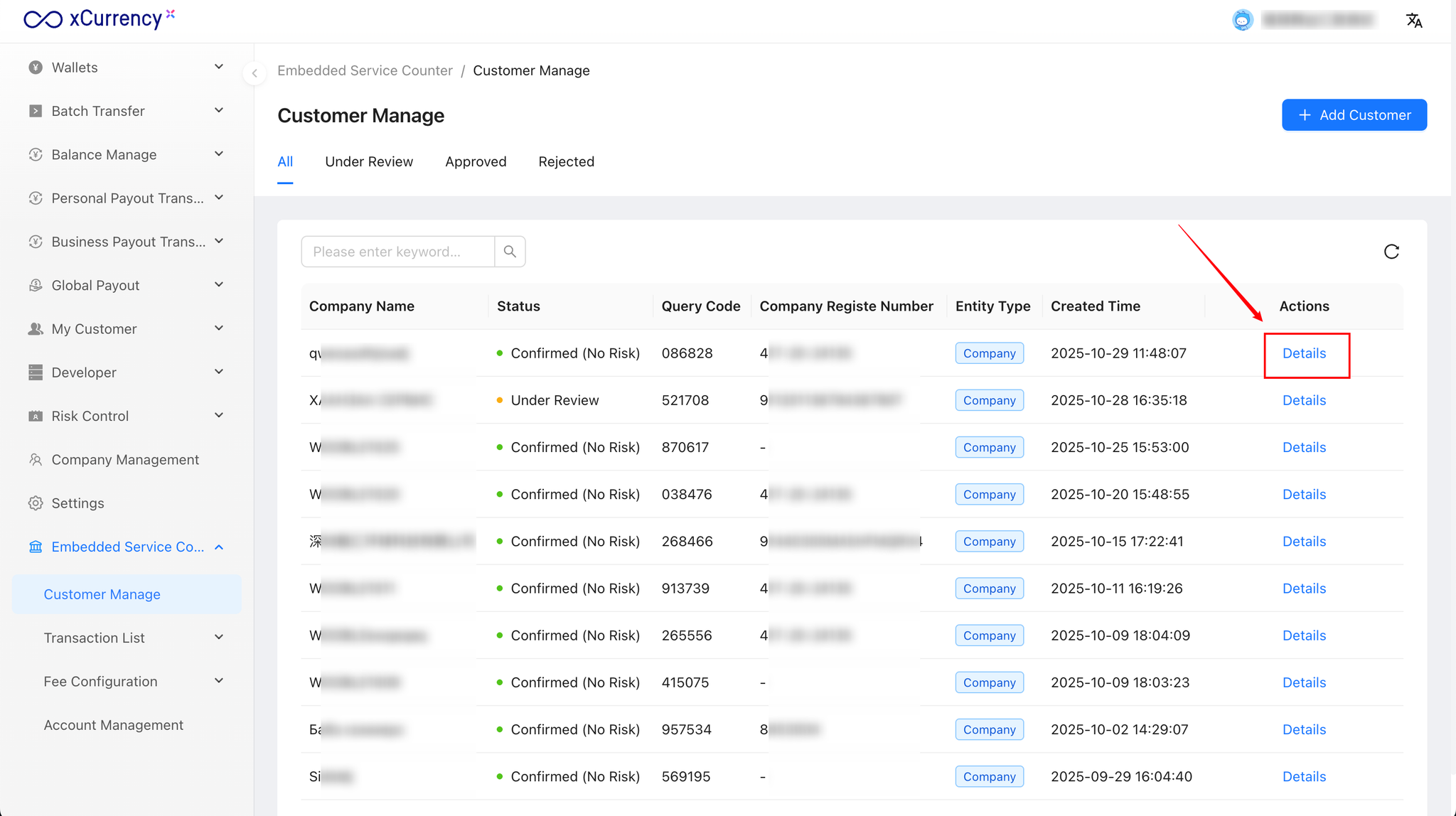

Customer Management

In the Merchant Management module, you can view all remitters/companies that have onboarded through the Embedded Service Counter product.

You will need to perform onboarding admission actions here (approve or reject).

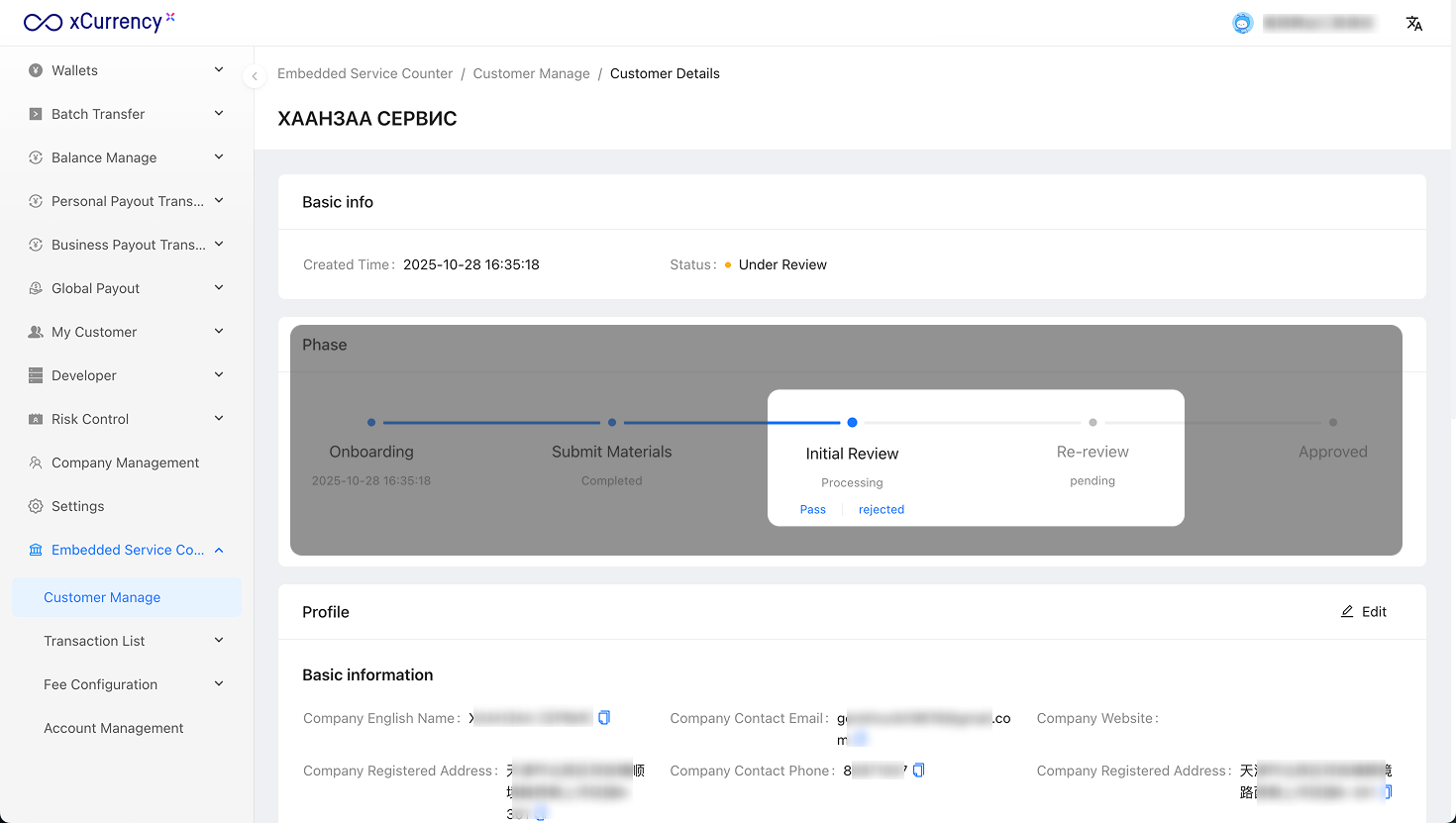

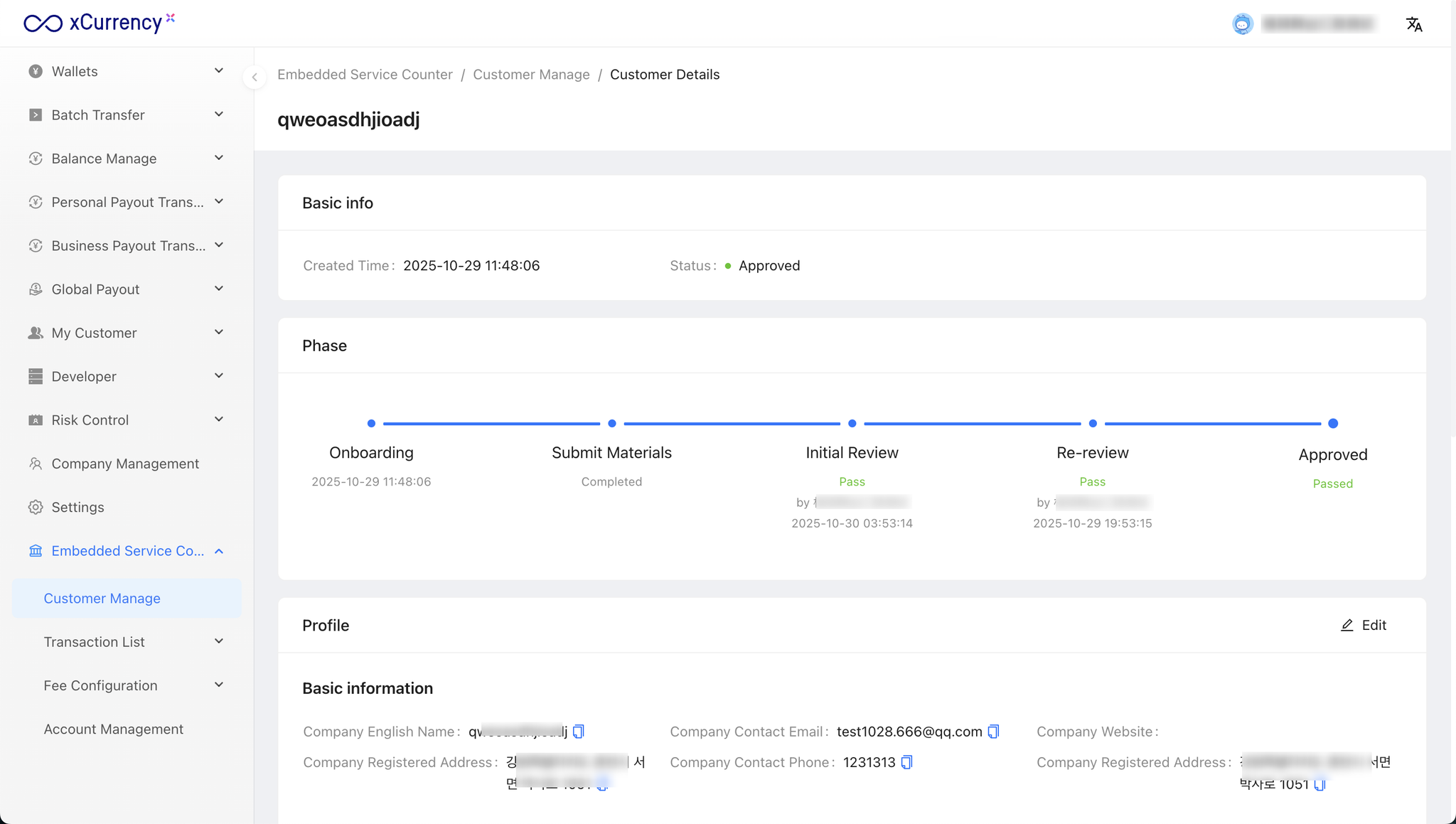

Review Customer Profiles

Click “Details” to enter the customer profile page

Conduct Profile Review

Once approved, your terminal customer can initiate remittance transactions via the Embedded Service Counter product.

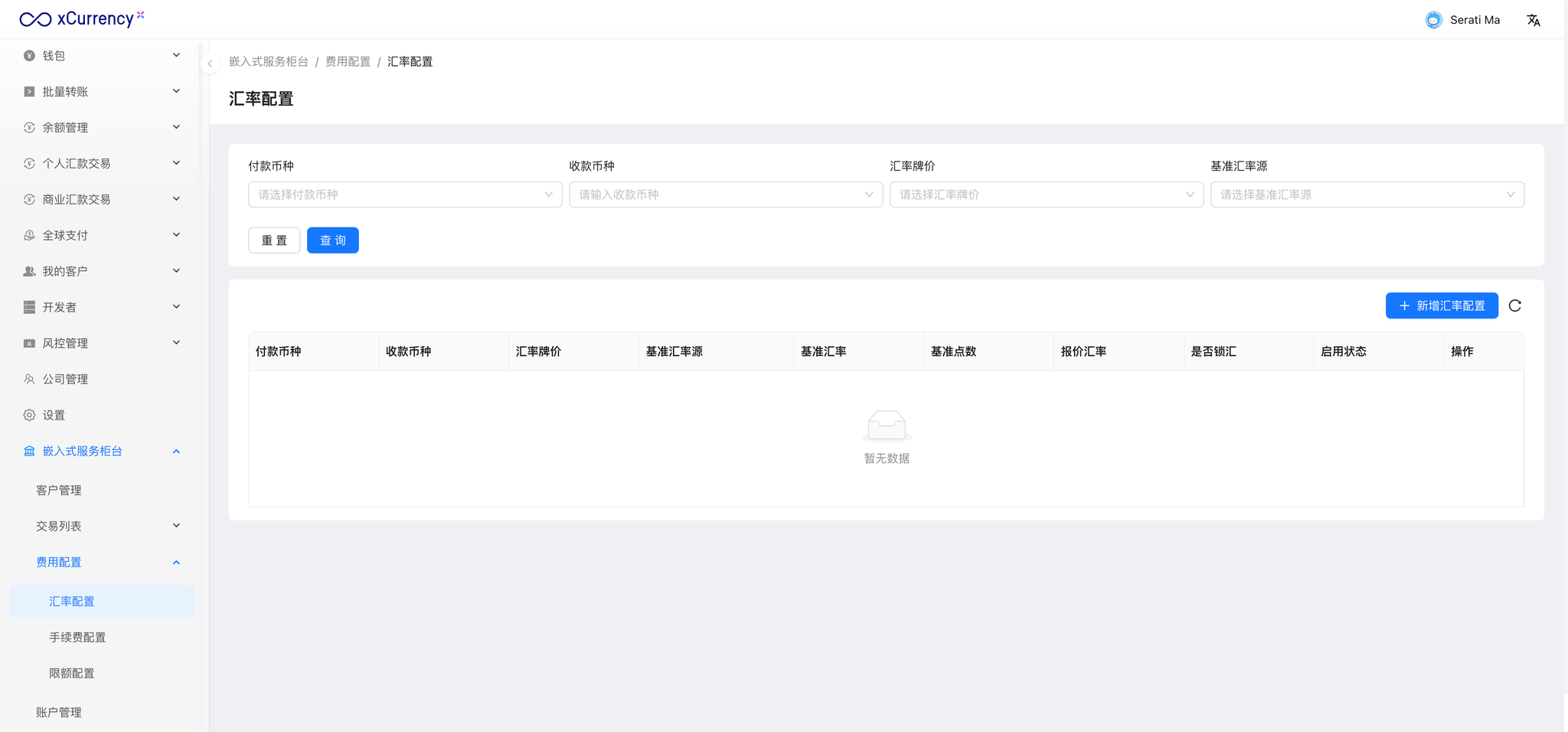

Fee Configuration

The Fee Configuration module is used to centrally manage cross-border remittance cost parameters and pricing strategies for white-label partner institutions.

Administrators can flexibly configure exchange rates, fees, and limit rules by currency, channel, and country/region.

The system automatically applies the relevant configuration when a transaction is initiated, enabling differentiated pricing and compliance control.

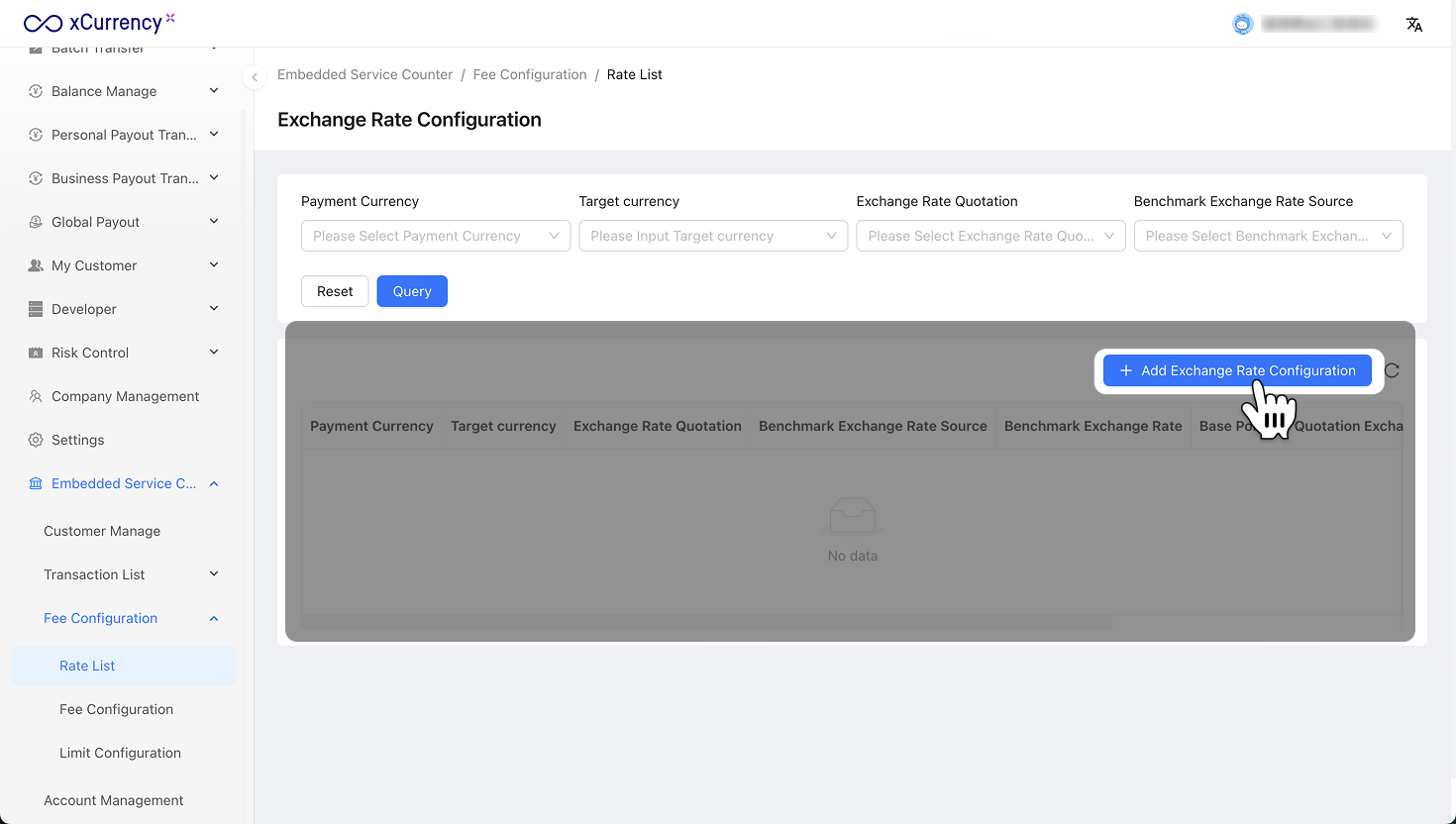

Exchange Rate Configuration

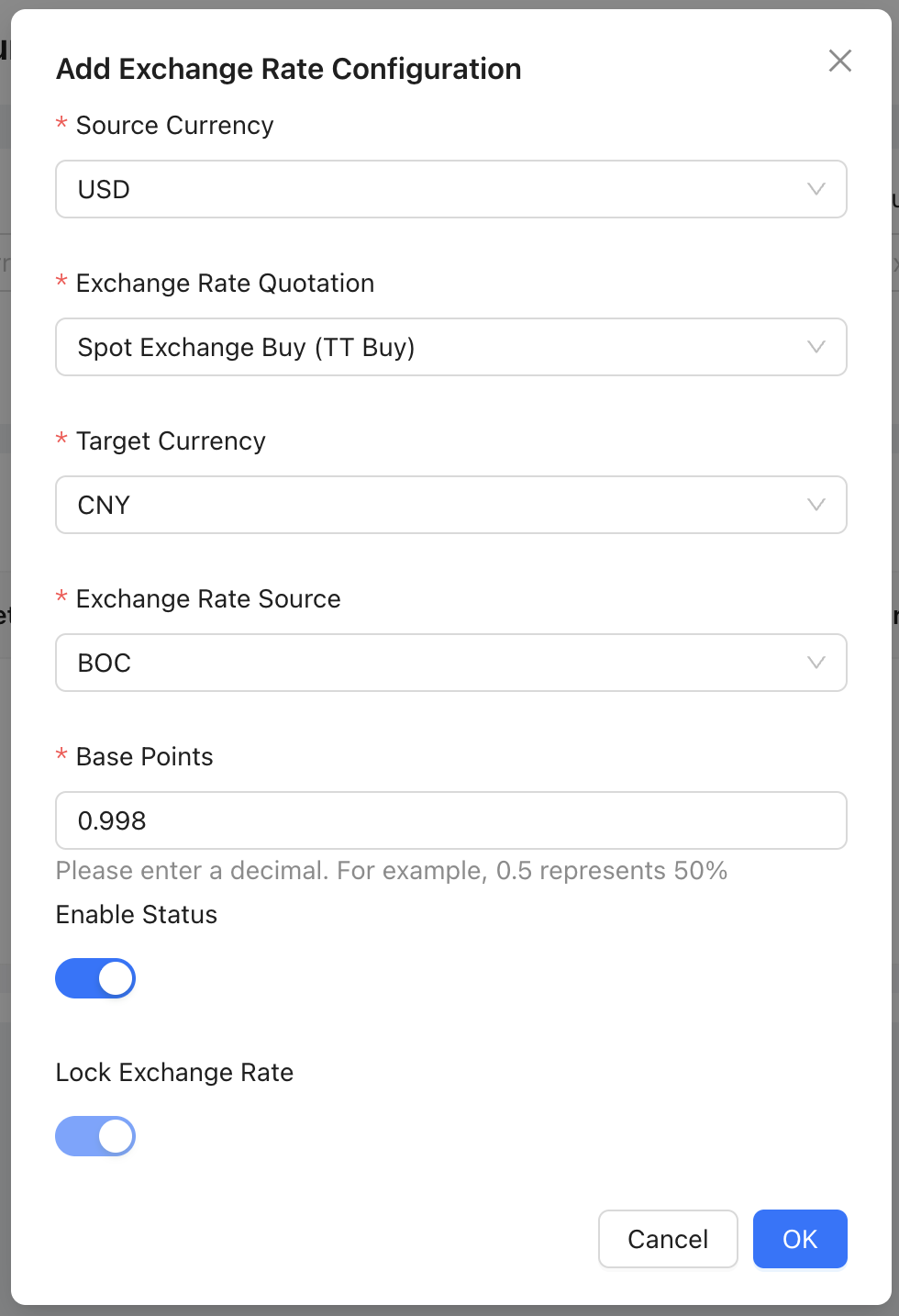

Click [Add Exchange Rate Configuration] on the right to proceed.

* Source Currency:

The currency initiating the exchange, i.e., the remittance outgoing currency.

The system calculates the conversion result based on the exchange rate between this and the target currency.

* Exchange Rate Quotation:Defines the base rate type used for currency conversion in cross-border remittance calculations.

Different rate types represent bank pricing standards for various transaction directions (buy/sell) or forms (telegraphic transfer/cash).

Supported rate types include:

- Spot Exchange Buy (TT Buy): The rate at which the bank purchases foreign currency telegraphic transfers from customers (used for inbound remittances).

- Spot Exchange Sell (TT Sell): The rate at which the bank sells foreign currency telegraphic transfers to customers (used for outbound remittances).

- Central Parity Rate: The average of buying and selling rates, typically used as a market benchmark or internal settlement rate.

- Cash Buy Rate/Cash Sell Rate: Used only for cash scenarios, not for telegraphic transfers.

* Target Currency:The currency received or settled in the transaction.

* Exchange Rate Source:The data provider or source channel of the exchange rate, indicating reliability and update frequency.

* Basis Points :Represents the margin added to or subtracted from the base rate to account for platform profit or risk buffer.

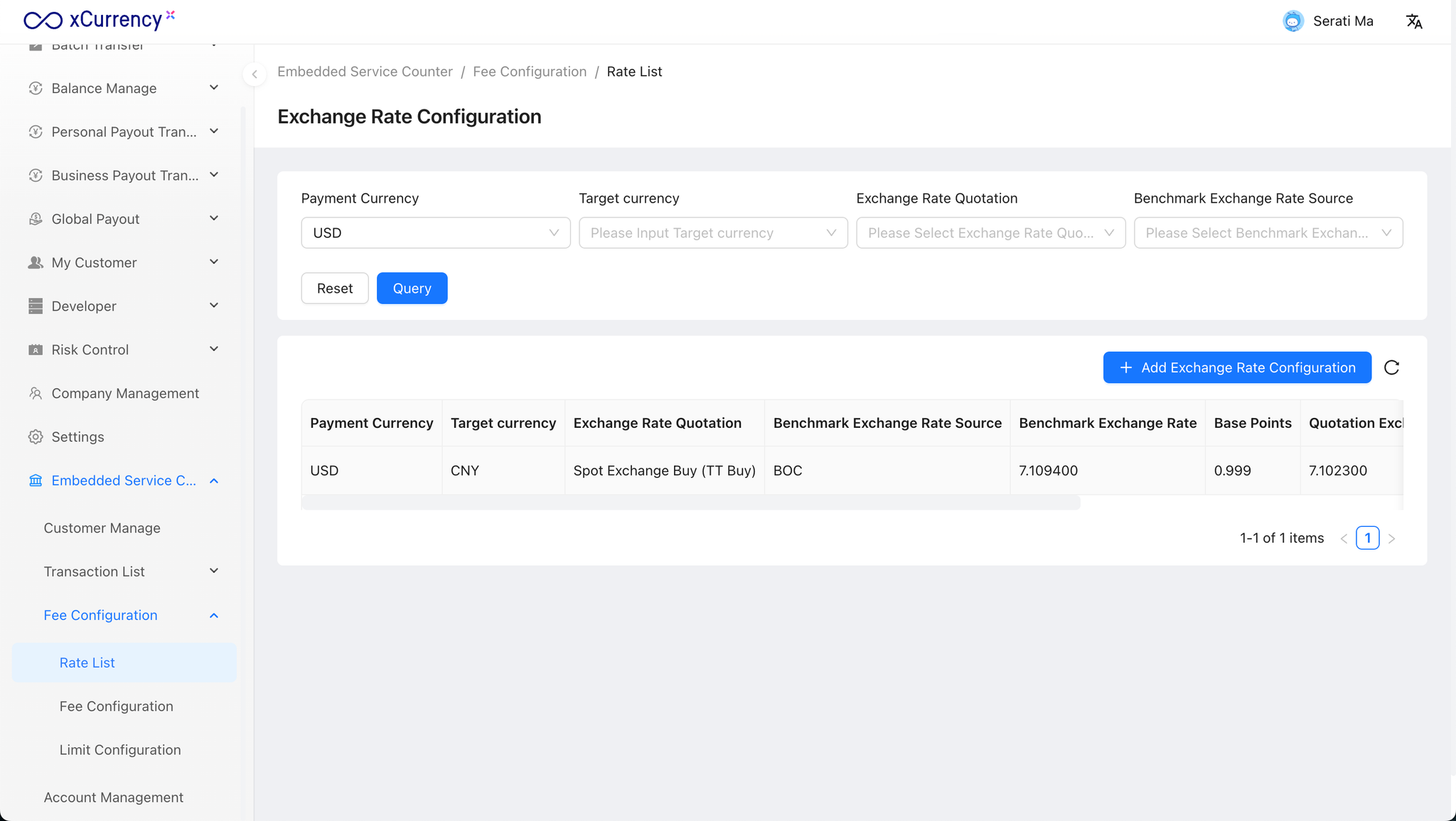

Once created, you can view the configuration in the Exchange Rate List, where you can also edit or delete entries.

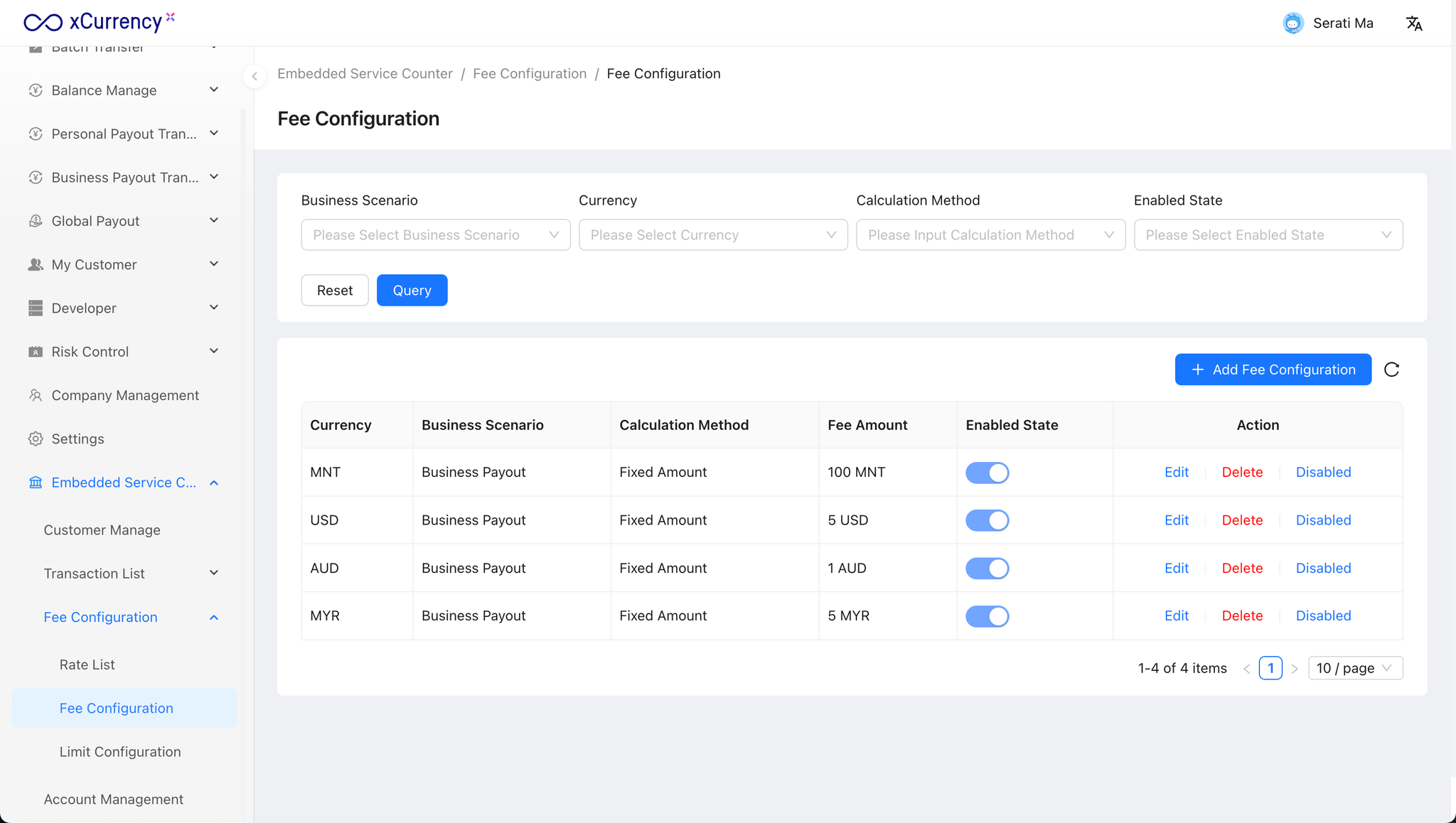

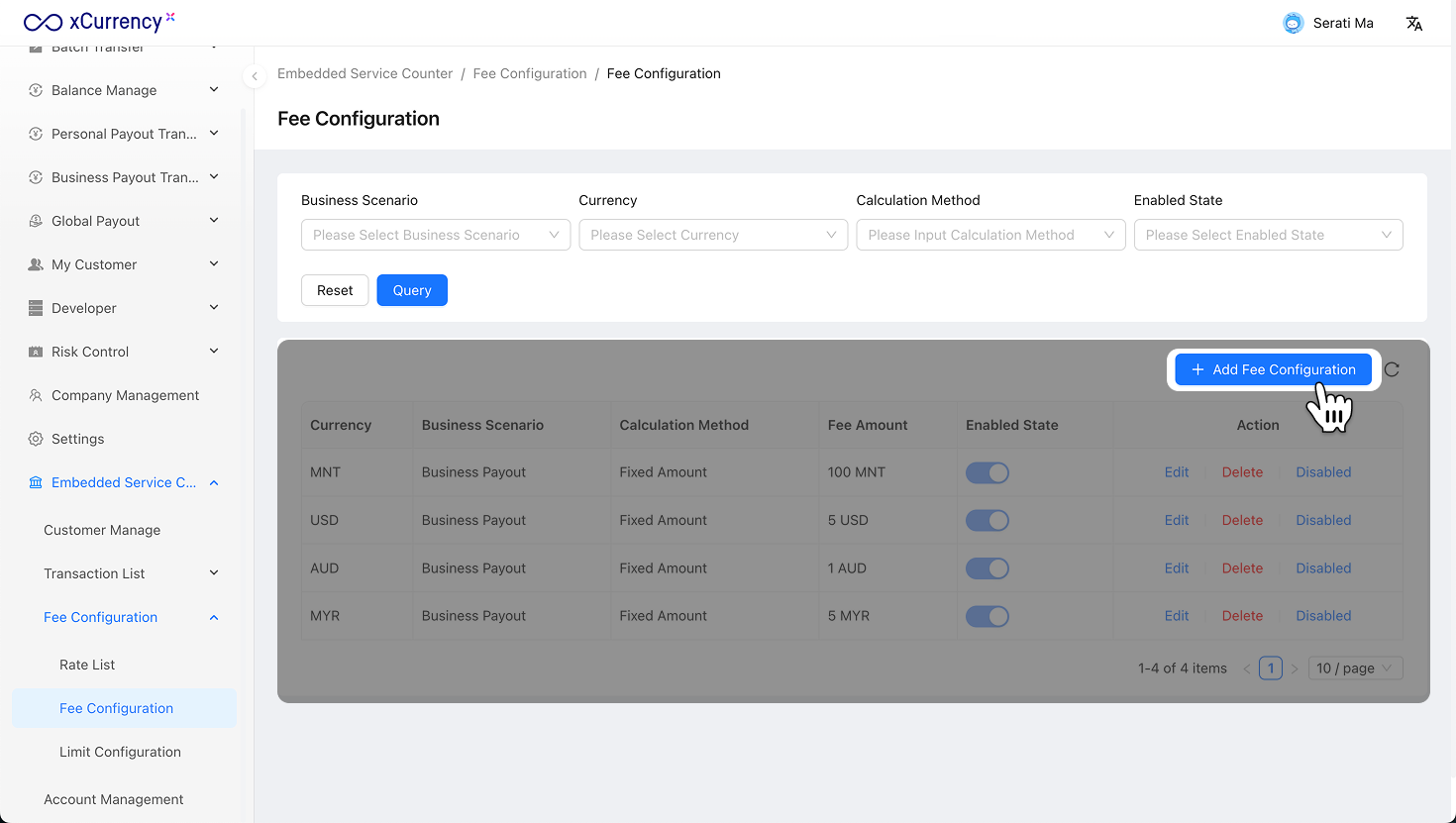

Fee Configuration

The system supports flexible fee models based on remittance type (Personal / Business), transaction amount, and payout currency — enabling differentiated pricing and flexible revenue sharing.

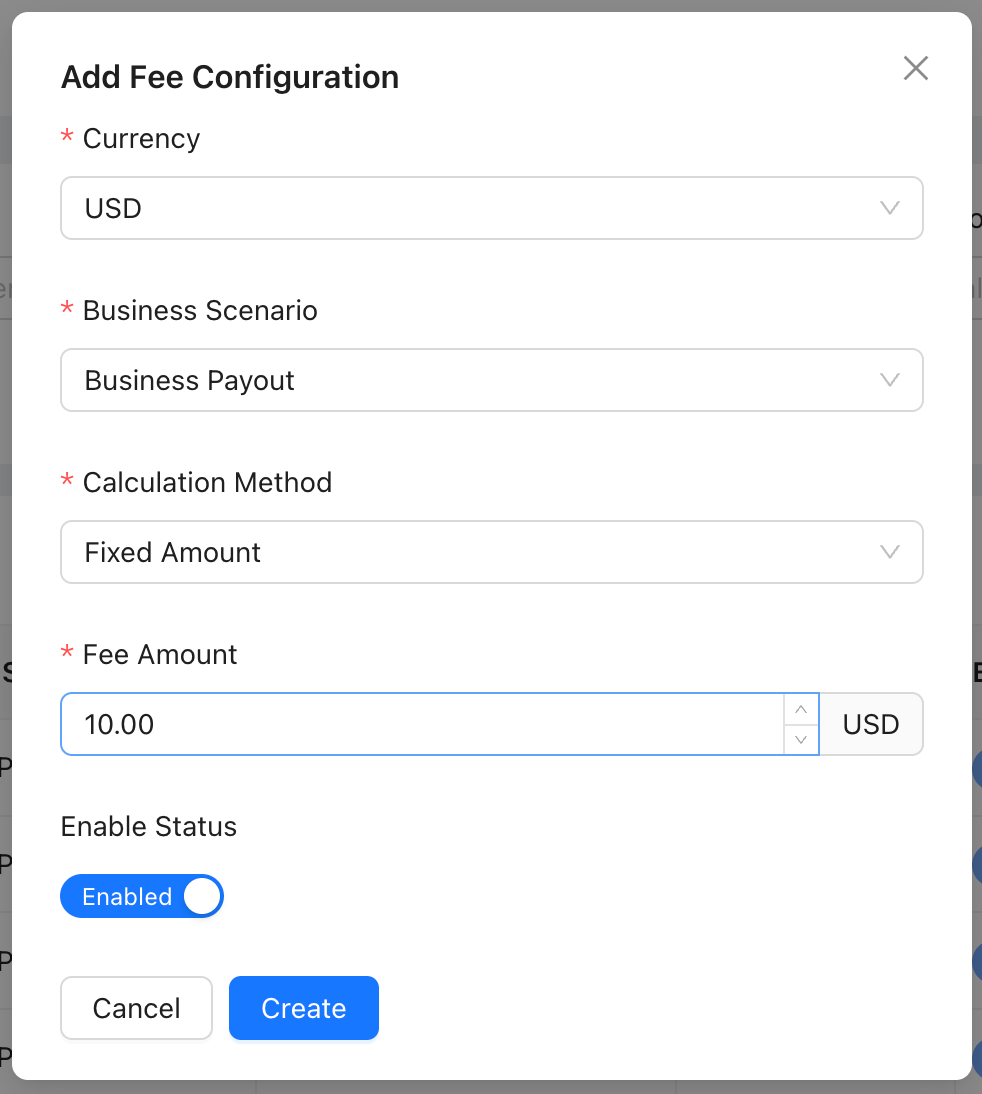

Click [Add Fee Configuration] to create a new one.

The system uses a single-currency fee model, meaning the fee is charged in the same currency as the remittance amount.

You can configure fees by business type, for example:

- Personal Remittance -

- Business Remittance

Two main calculation modes are supported:

- Fixed Fee: A fixed amount per transaction (e.g., 10 USD / 50 CNY).

- Percentage Fee: A percentage of the transaction amount (e.g., 0.5%).

You can also combine both (e.g., “Fixed + Percentage”) or set minimum/maximum fee limits.

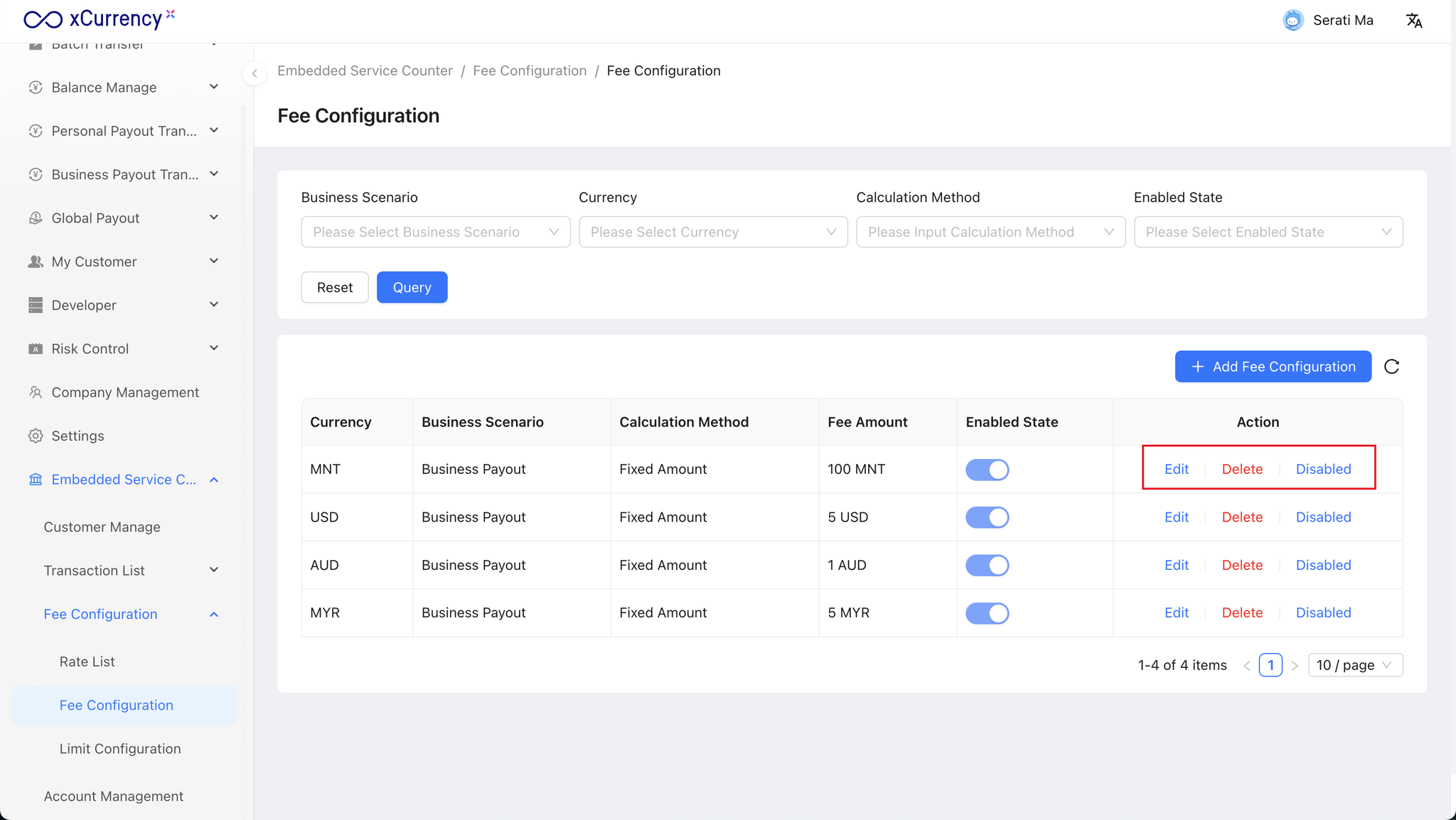

After adding, you can view it in the Fee Configuration List, with options to edit, delete, or disable.

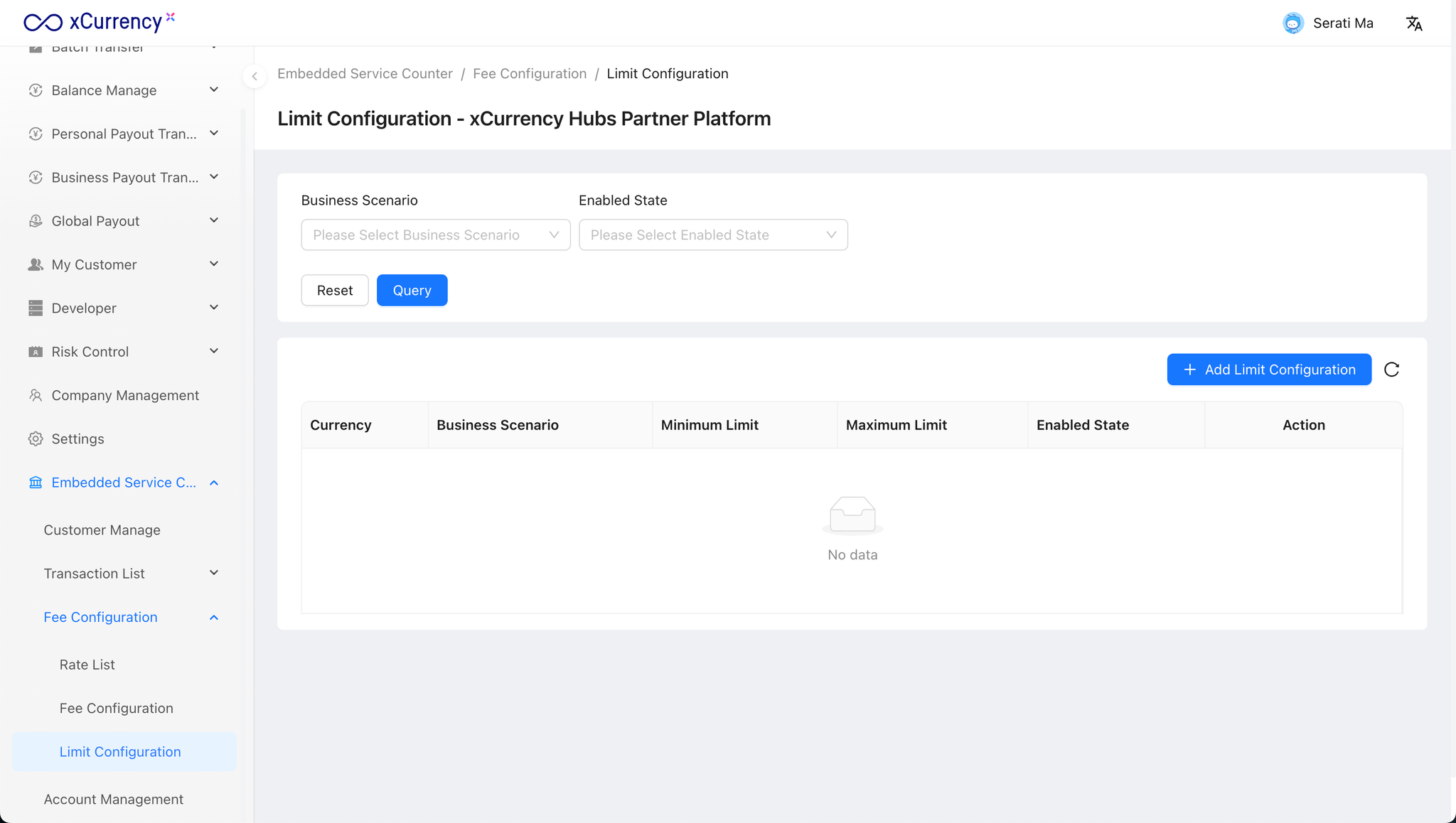

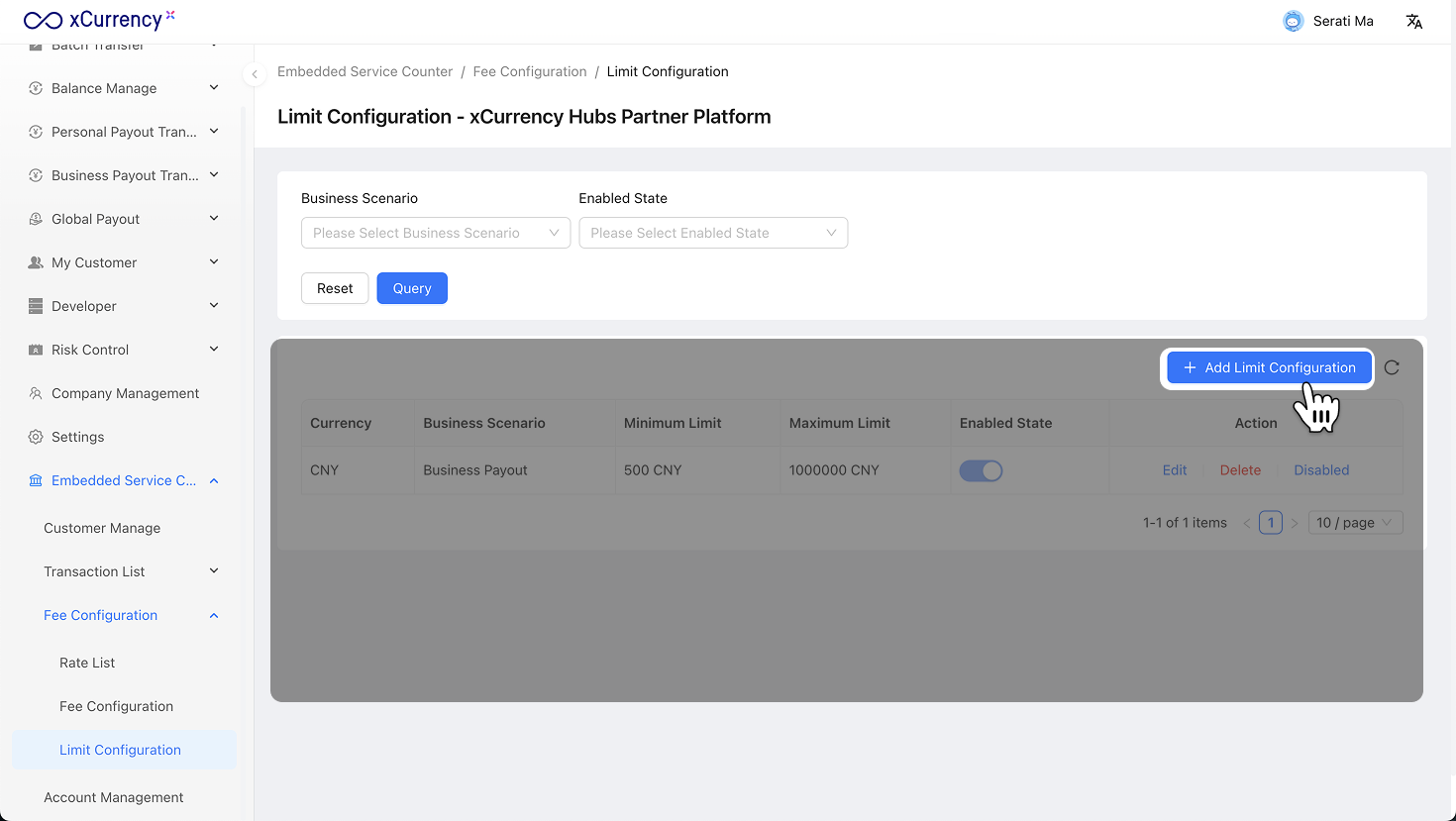

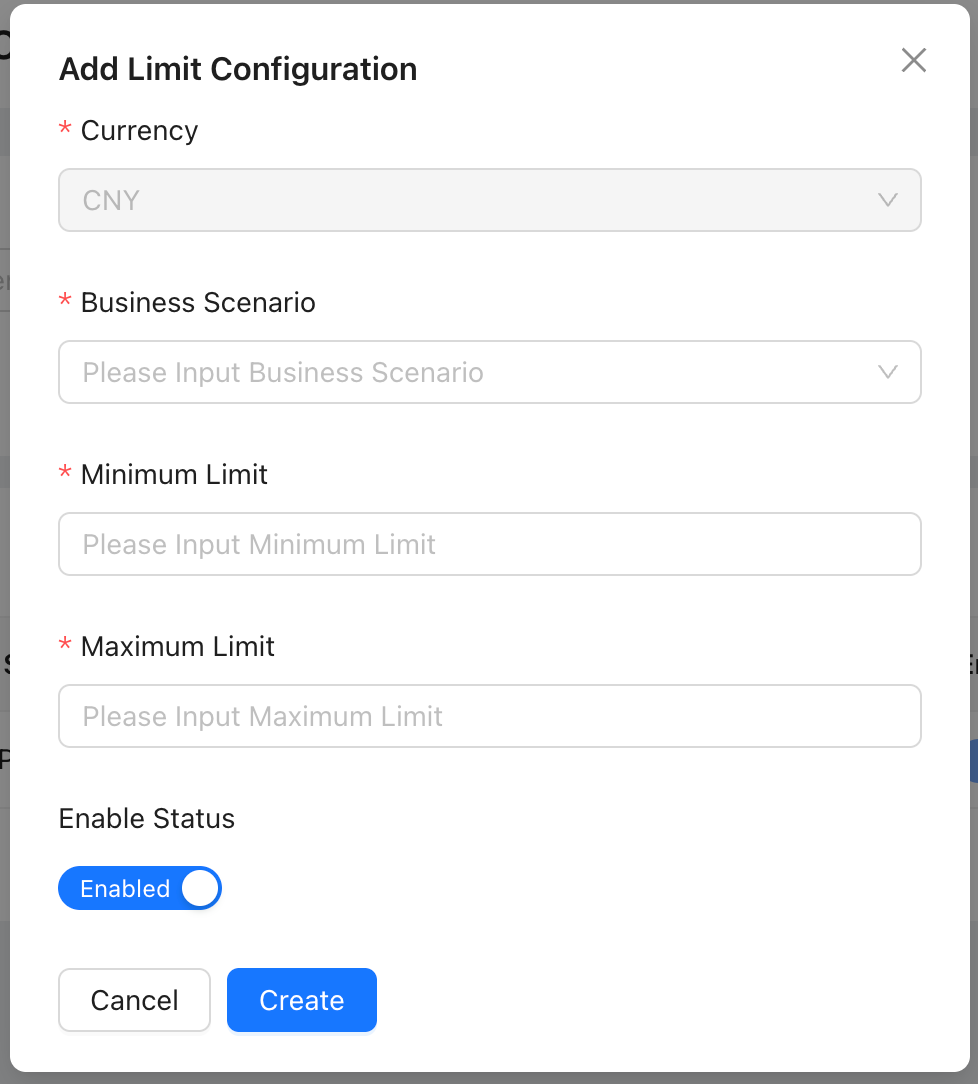

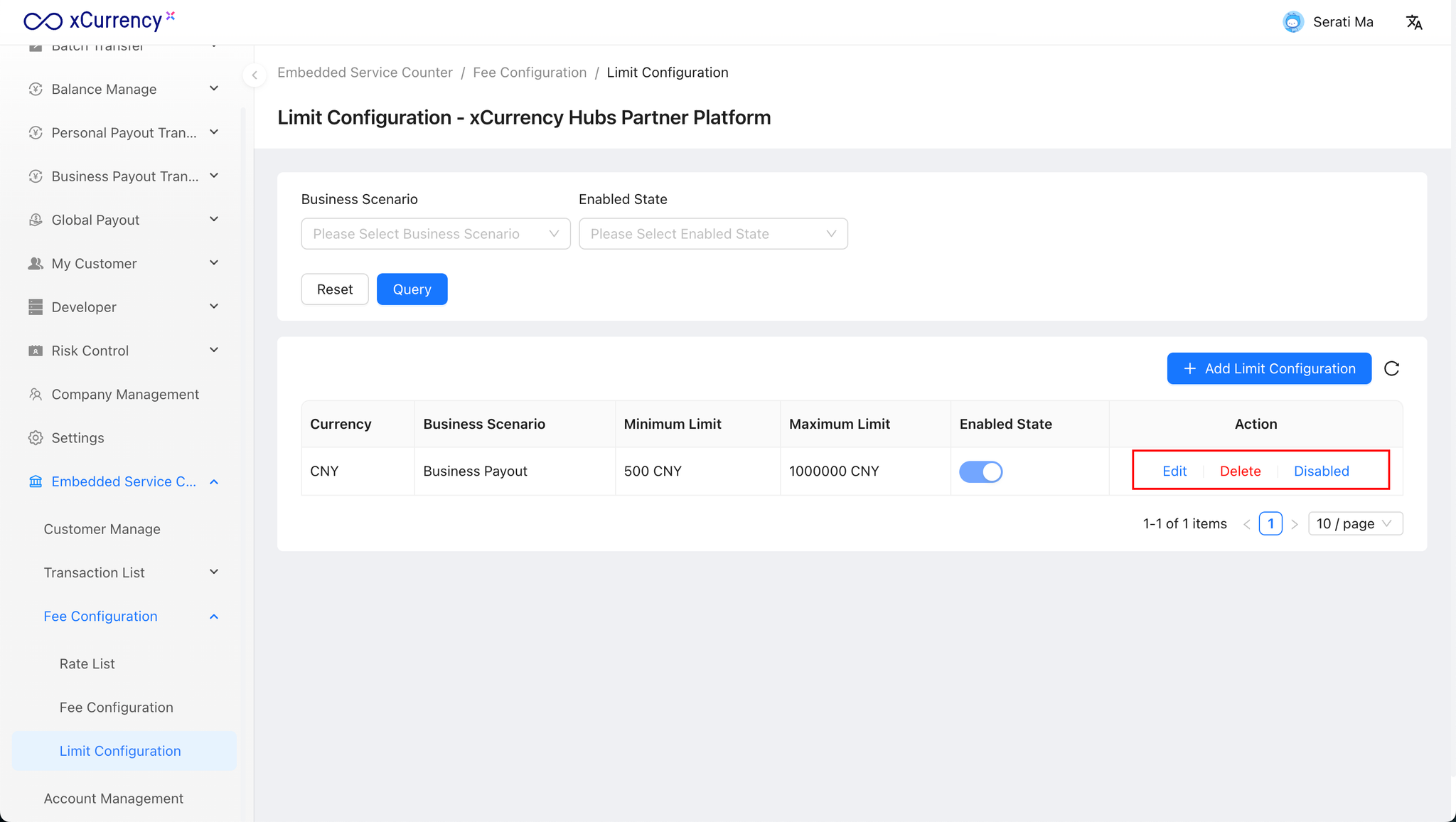

Limit Configuration

The Limit Configuration defines the permissible receiving amount range for different business scenarios (e.g., personal or business remittance).

This helps control risk, meet compliance requirements, and prevent abnormal transactions.

Currently, the system’s limit logic is based on the receiving amount in CNY, as all businesses ultimately settle in RMB.

Click [Add Limit Configuration] to proceed.

After adding, view it in the Limit Configuration List, where you can edit, delete, or disable entries.

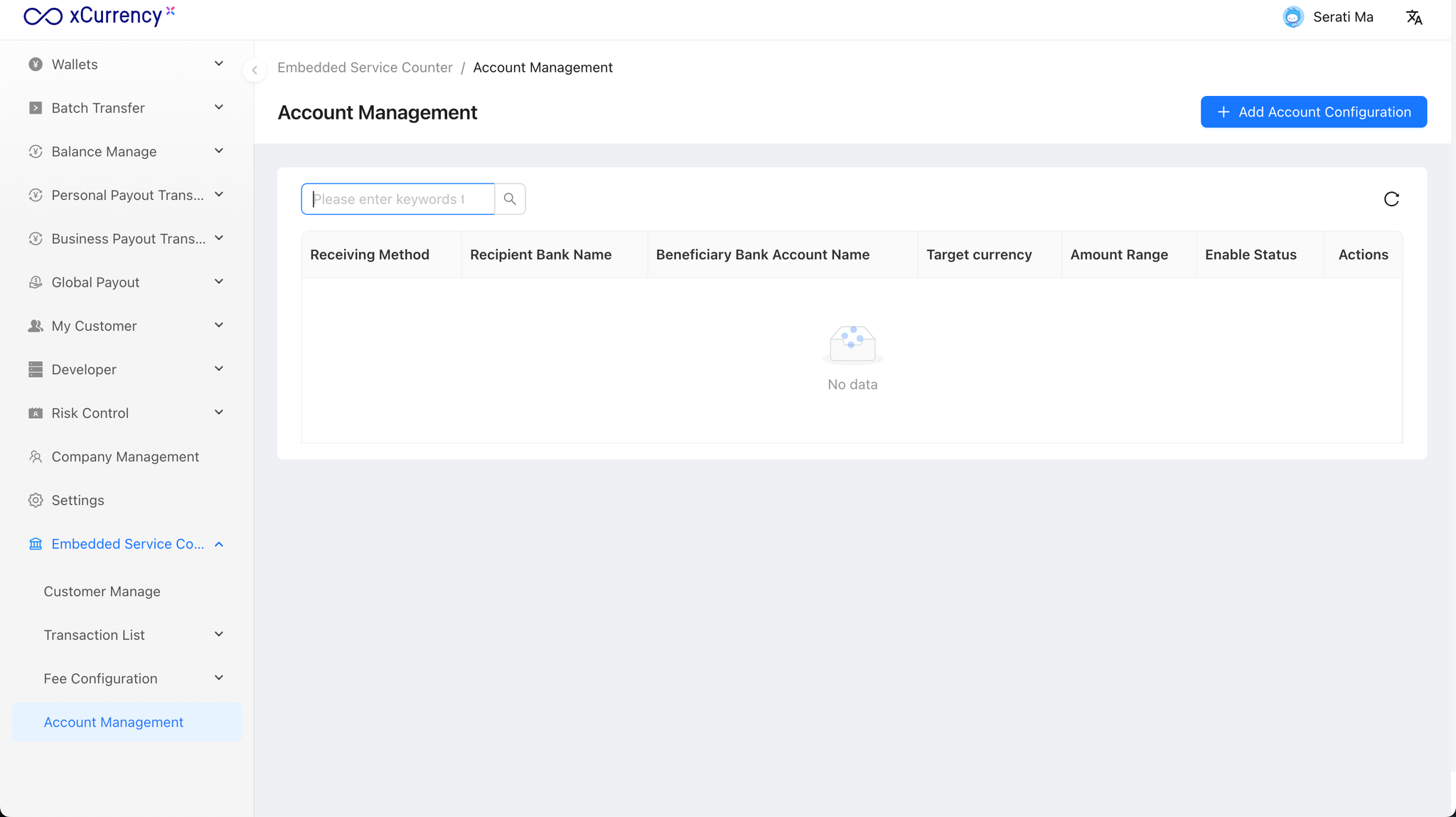

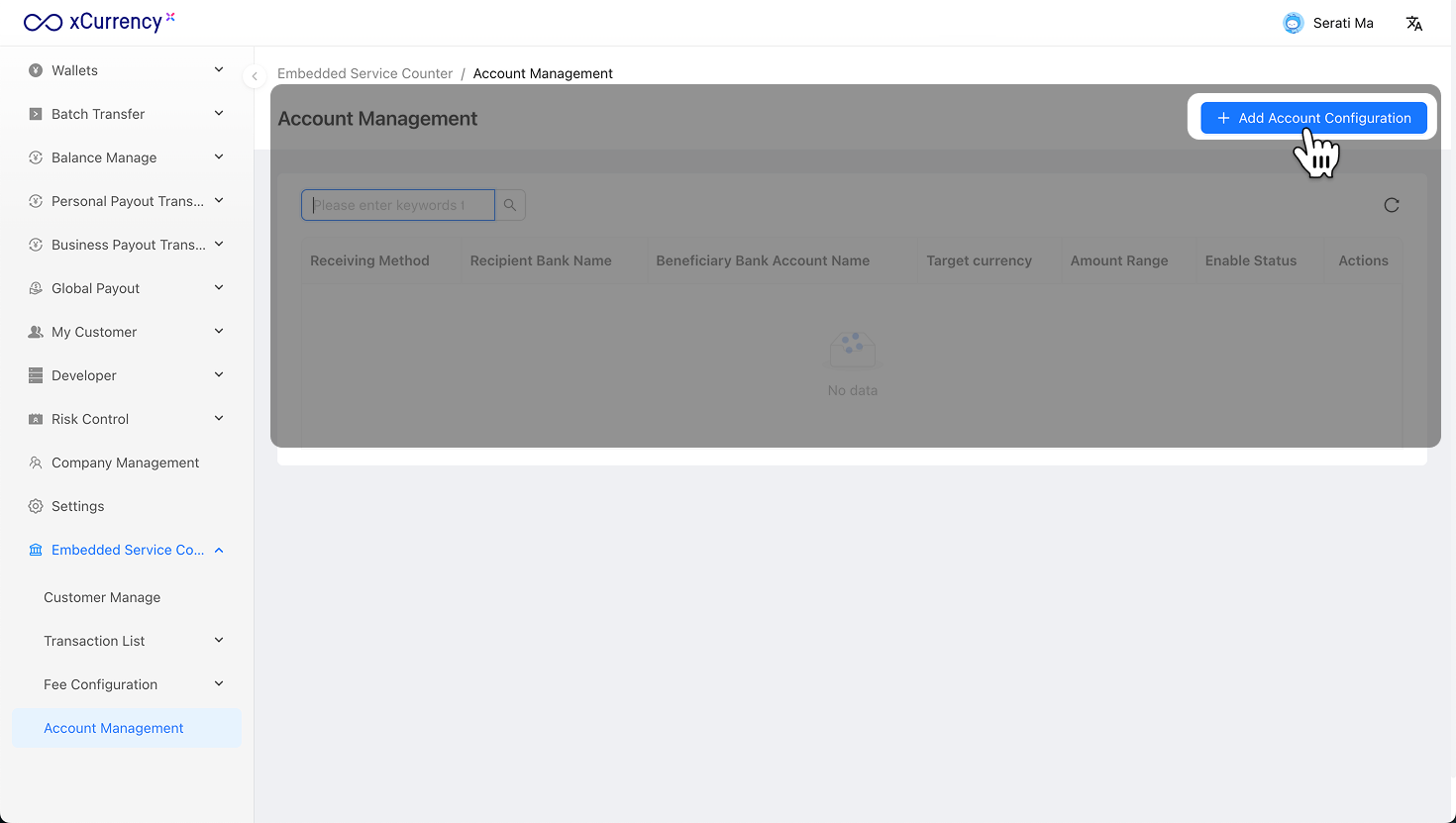

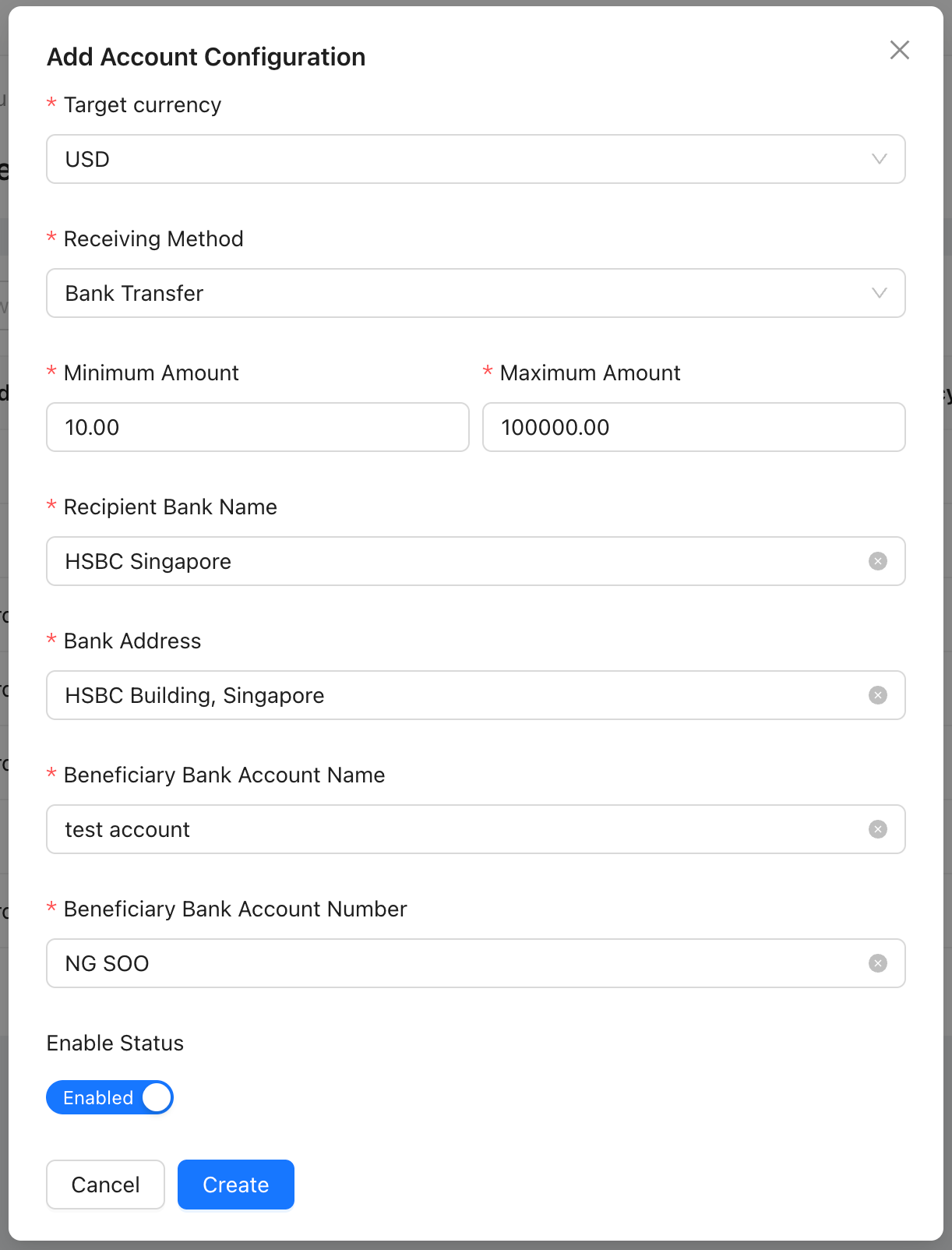

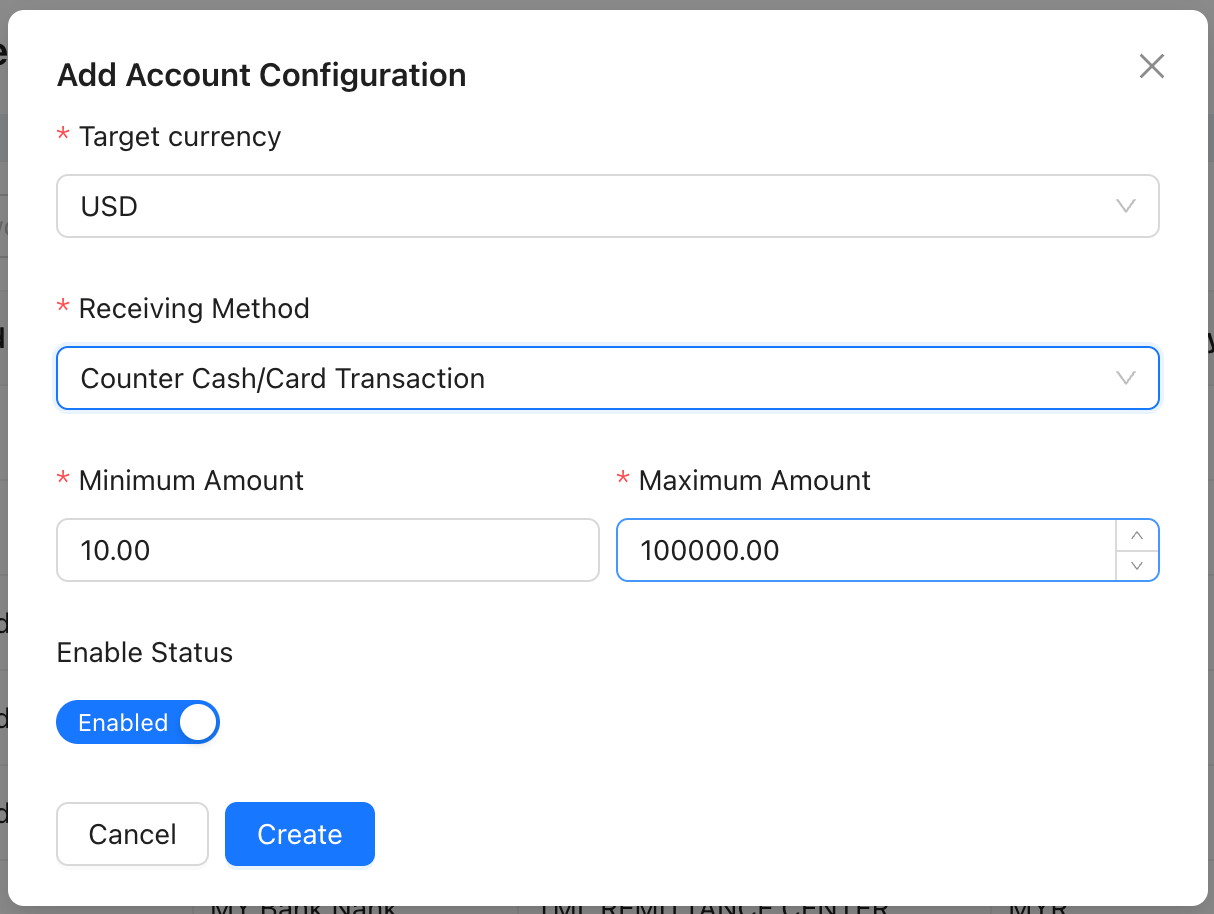

Account Management

The Account Configuration module allows remittance institutions to configure the receiving accounts used for collecting customer funds.

Based on business type, currency, and collection method, the system automatically matches the most appropriate receiving account, ensuring standardized and automated fund collection management.

Click [Add Account Configuration] to proceed.

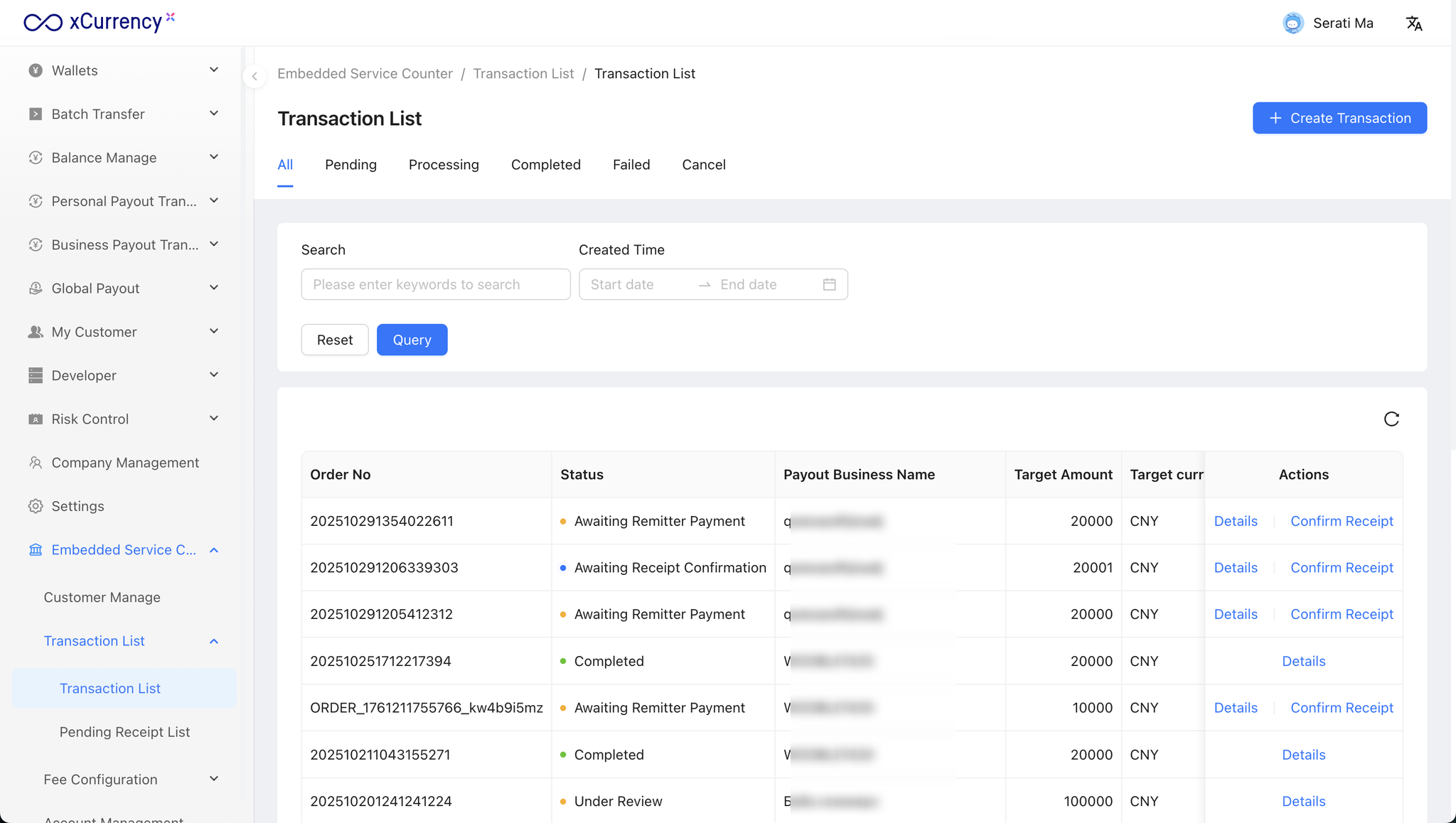

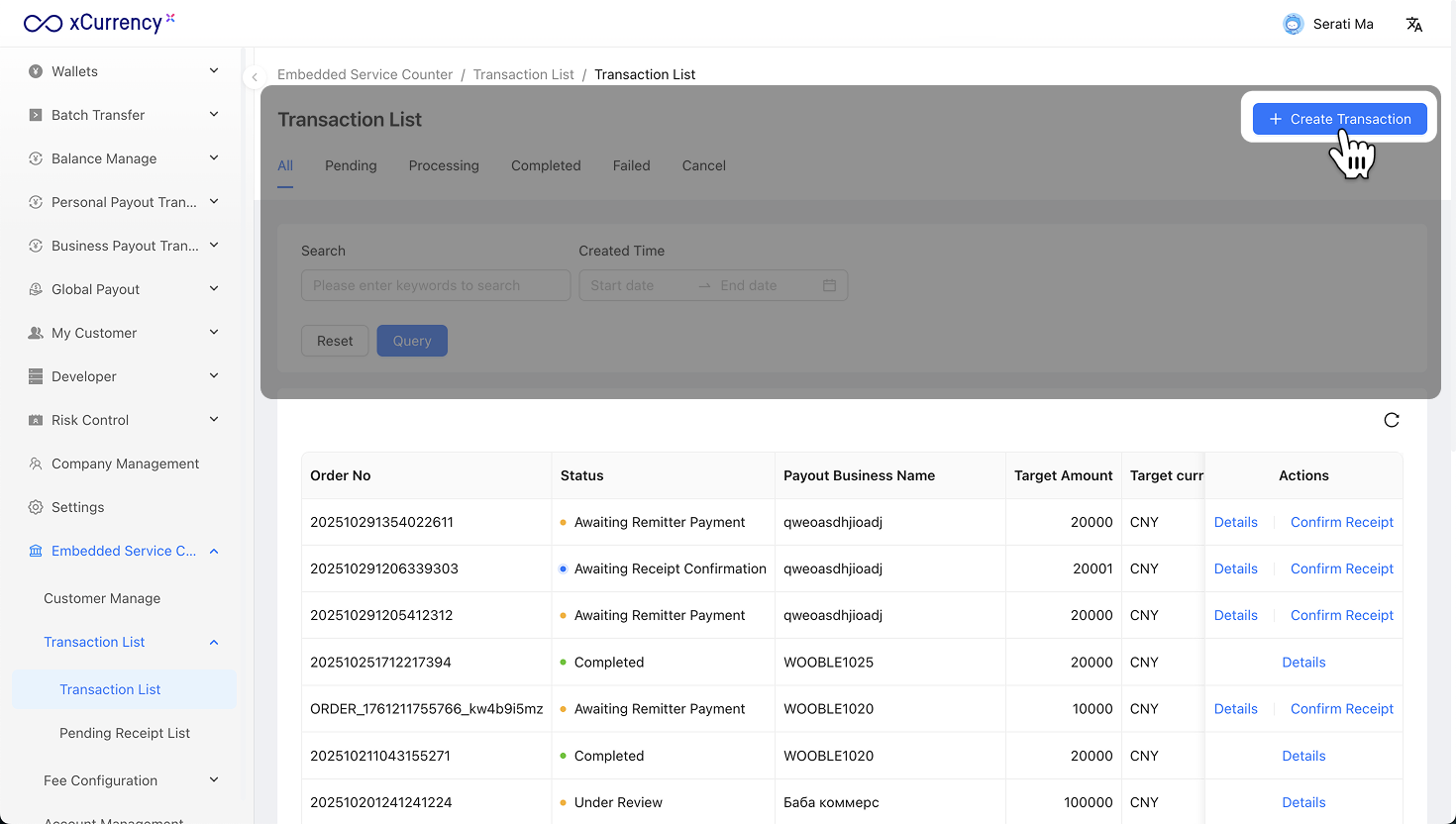

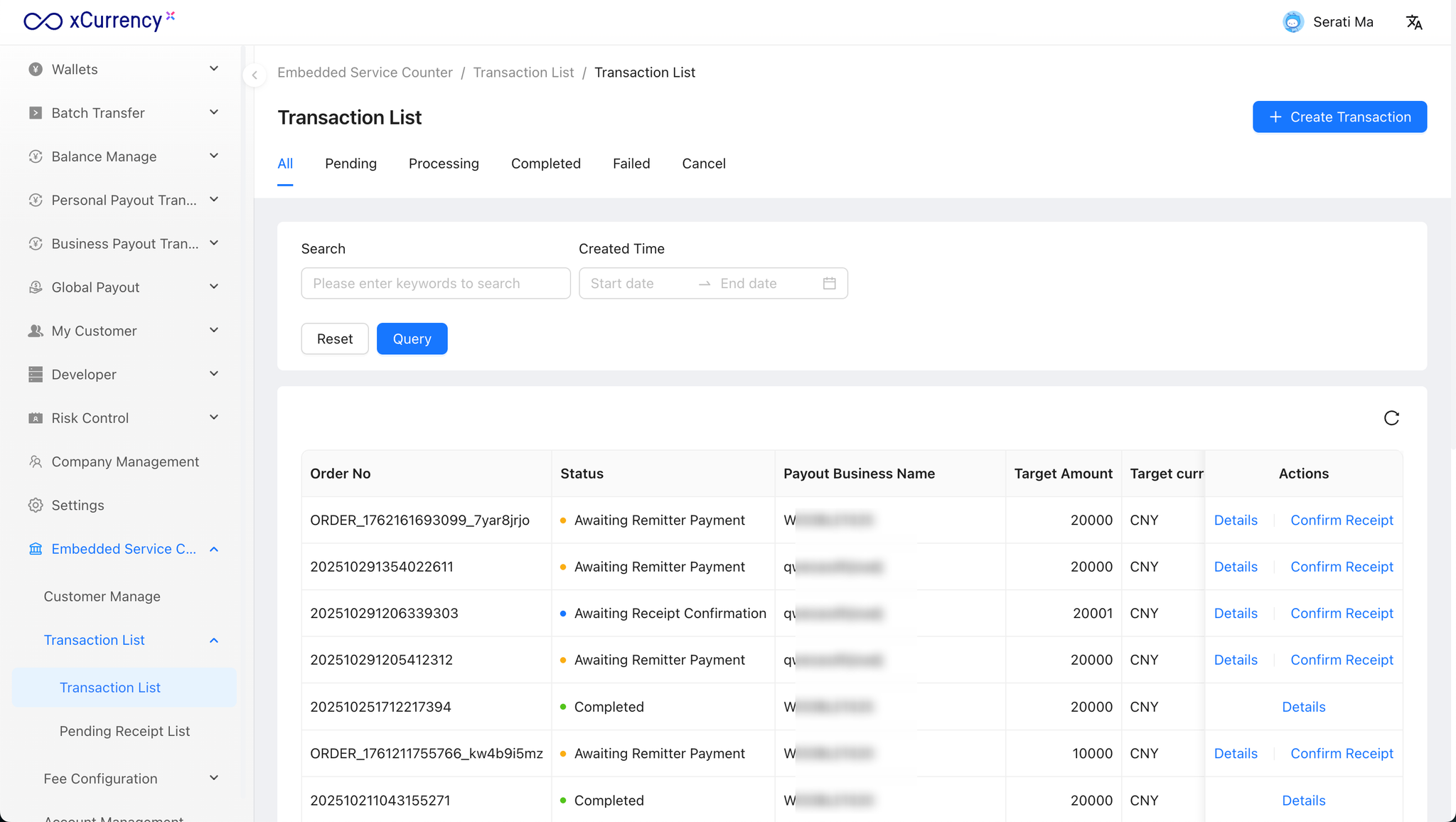

Transaction List

The Transaction List is the core operational module of the white-label remittance system, displaying all remittance orders generated via Embedded Counter Services.

Institutions can manage the entire order lifecycle here — including creating transactions, confirming receipt, compliance review tracking, and fund disbursement — enabling integrated cross-border transaction management and monitoring.

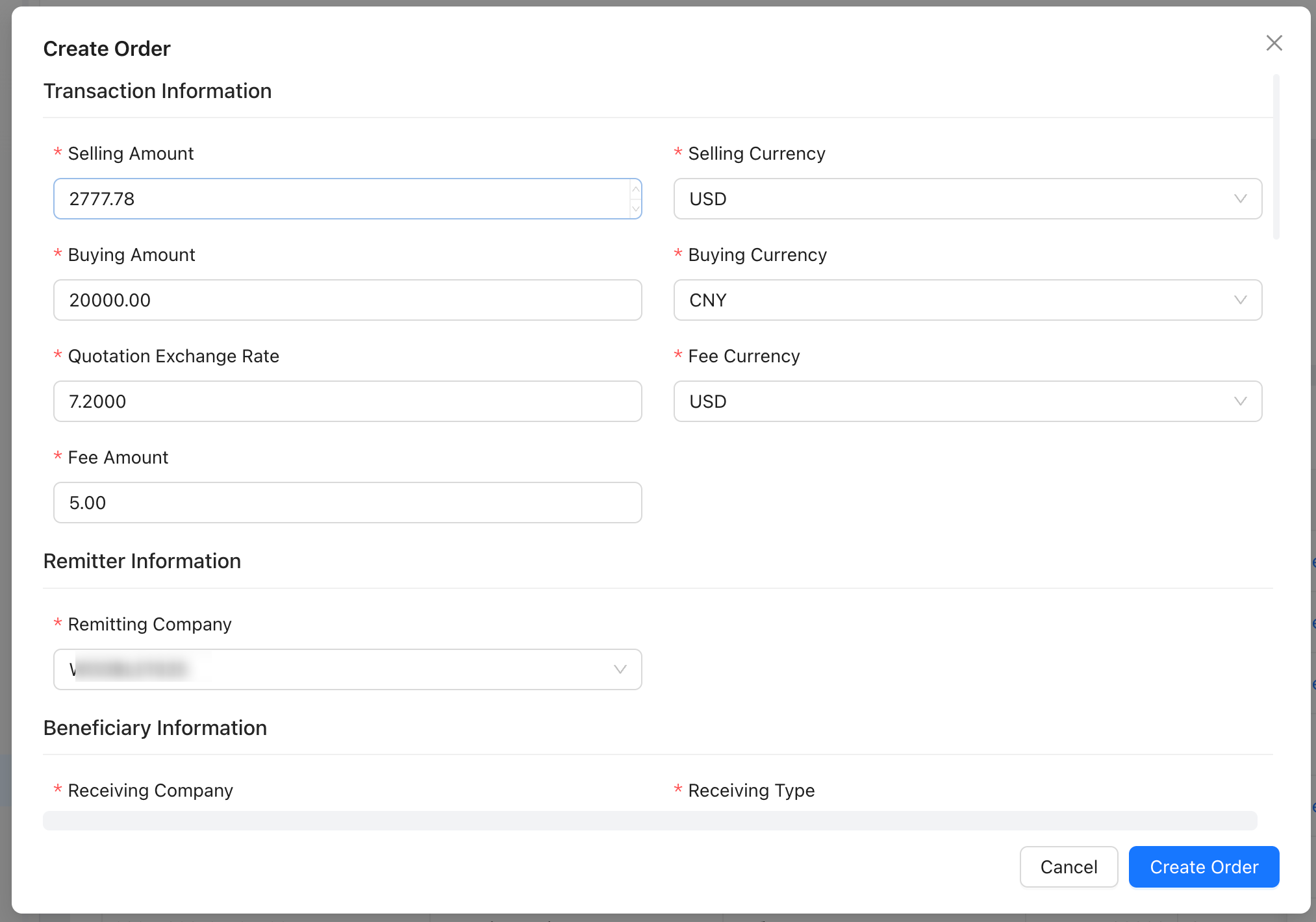

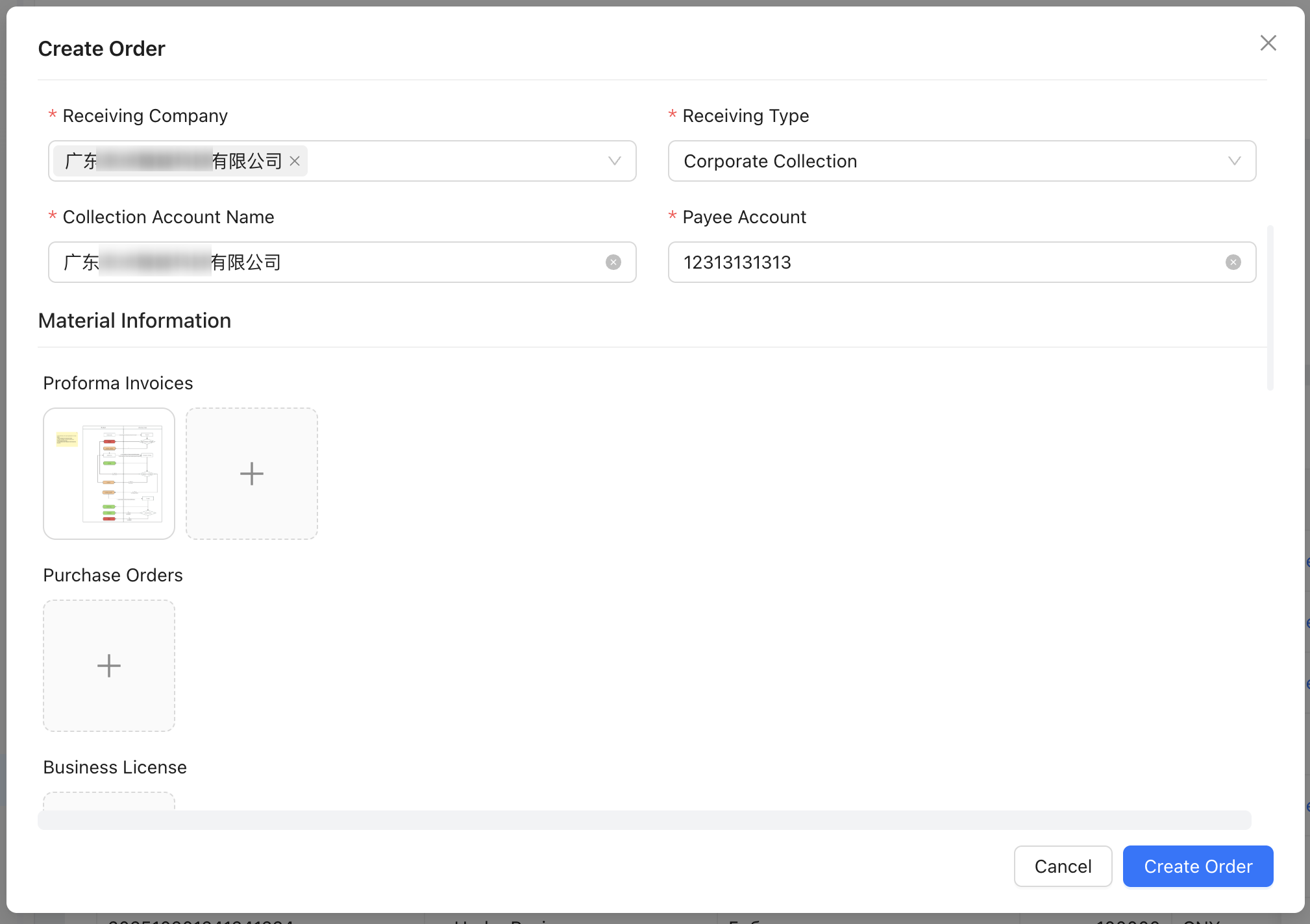

Create Transaction

Click the [Create Transaction] button in the top-right corner to manually initiate a remittance.

When manually creating an order, fill in all necessary details, including amount, currency, fees, buyer/seller information, and supporting documents.

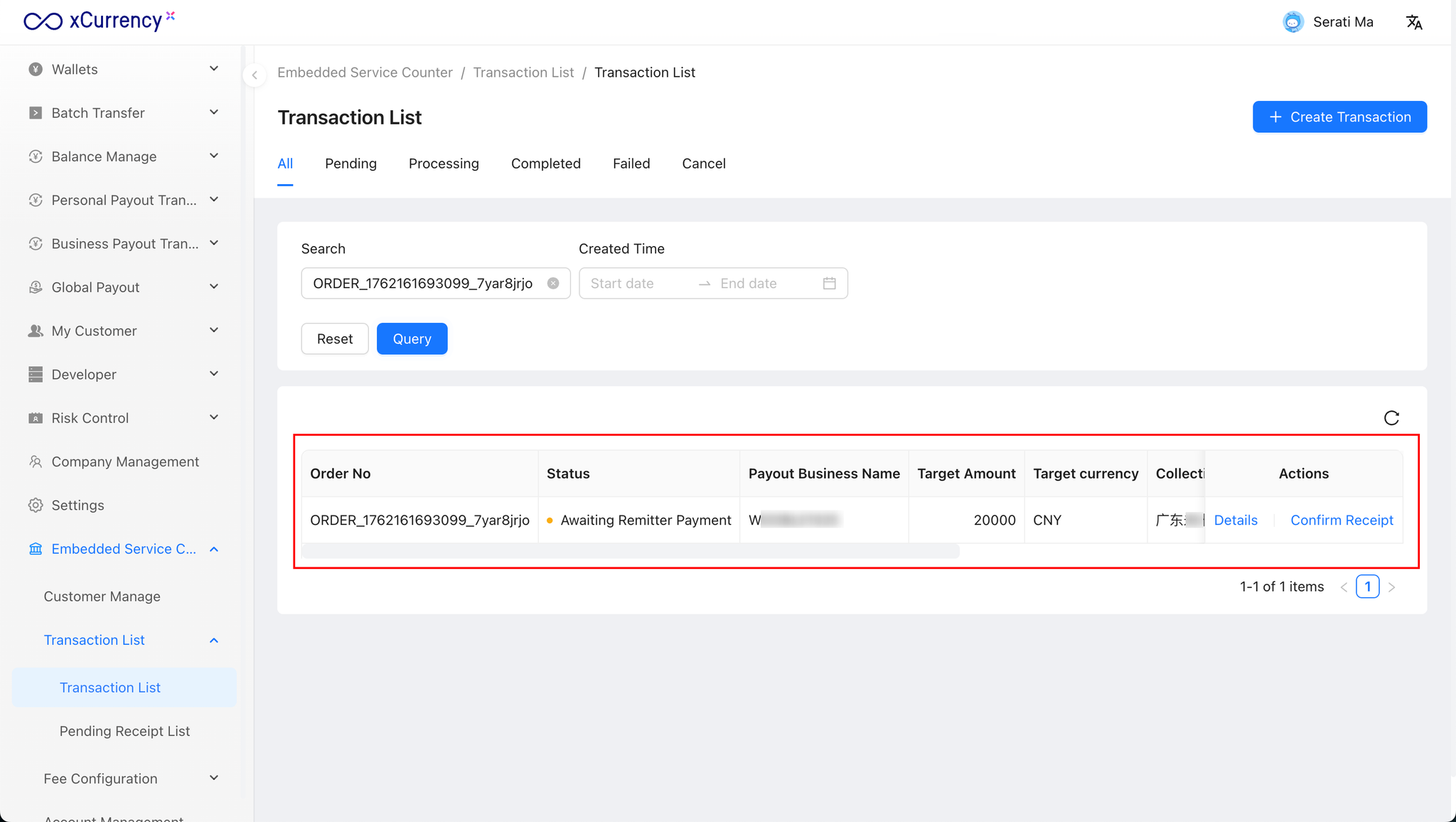

Once created, you can view the order in the list.

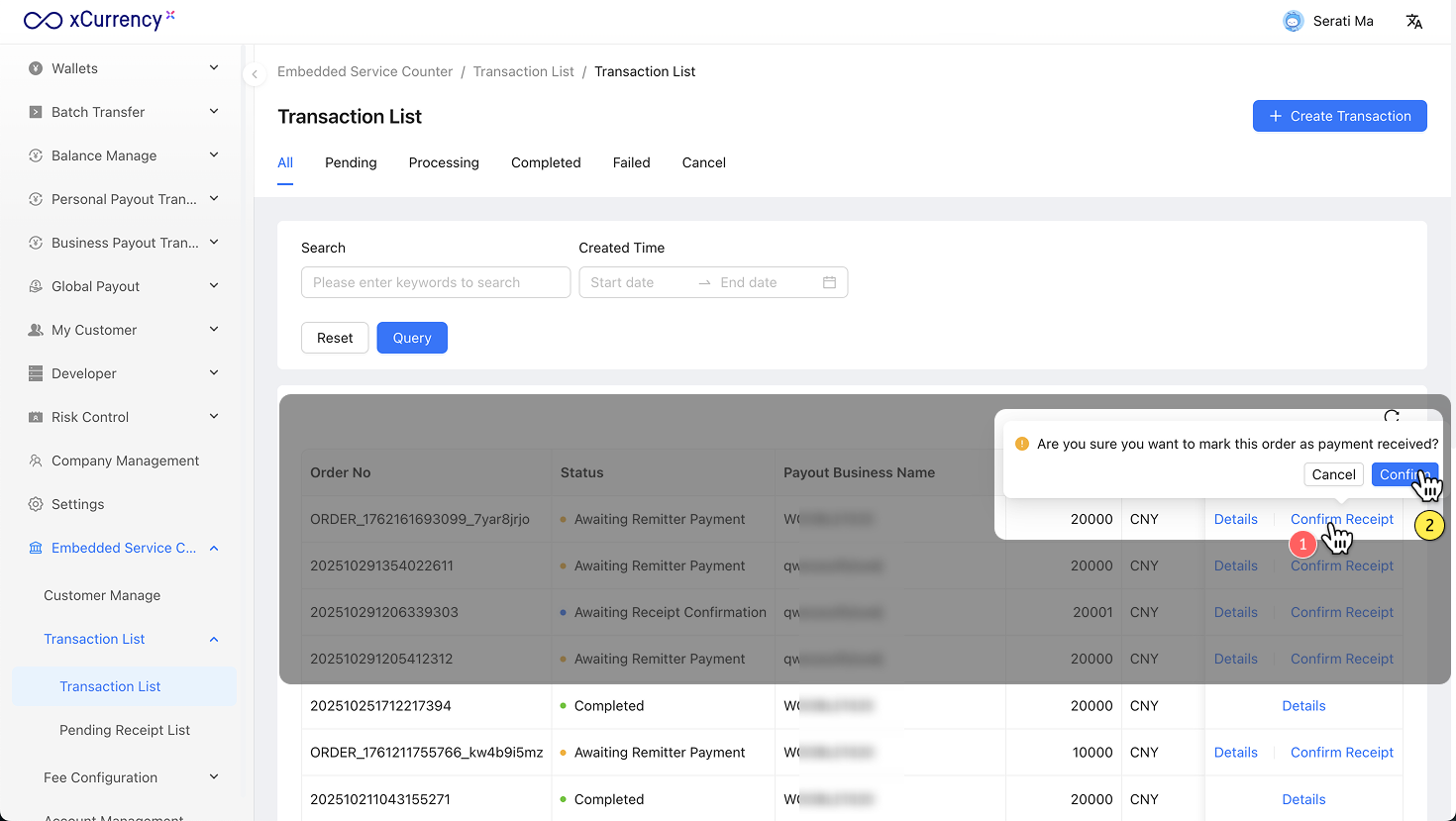

Pending Receipt List

Orders in the Pending Receipt list require operators to verify incoming funds.

After confirming that funds have arrived in the institution’s account, perform the Confirm Receipt operation.

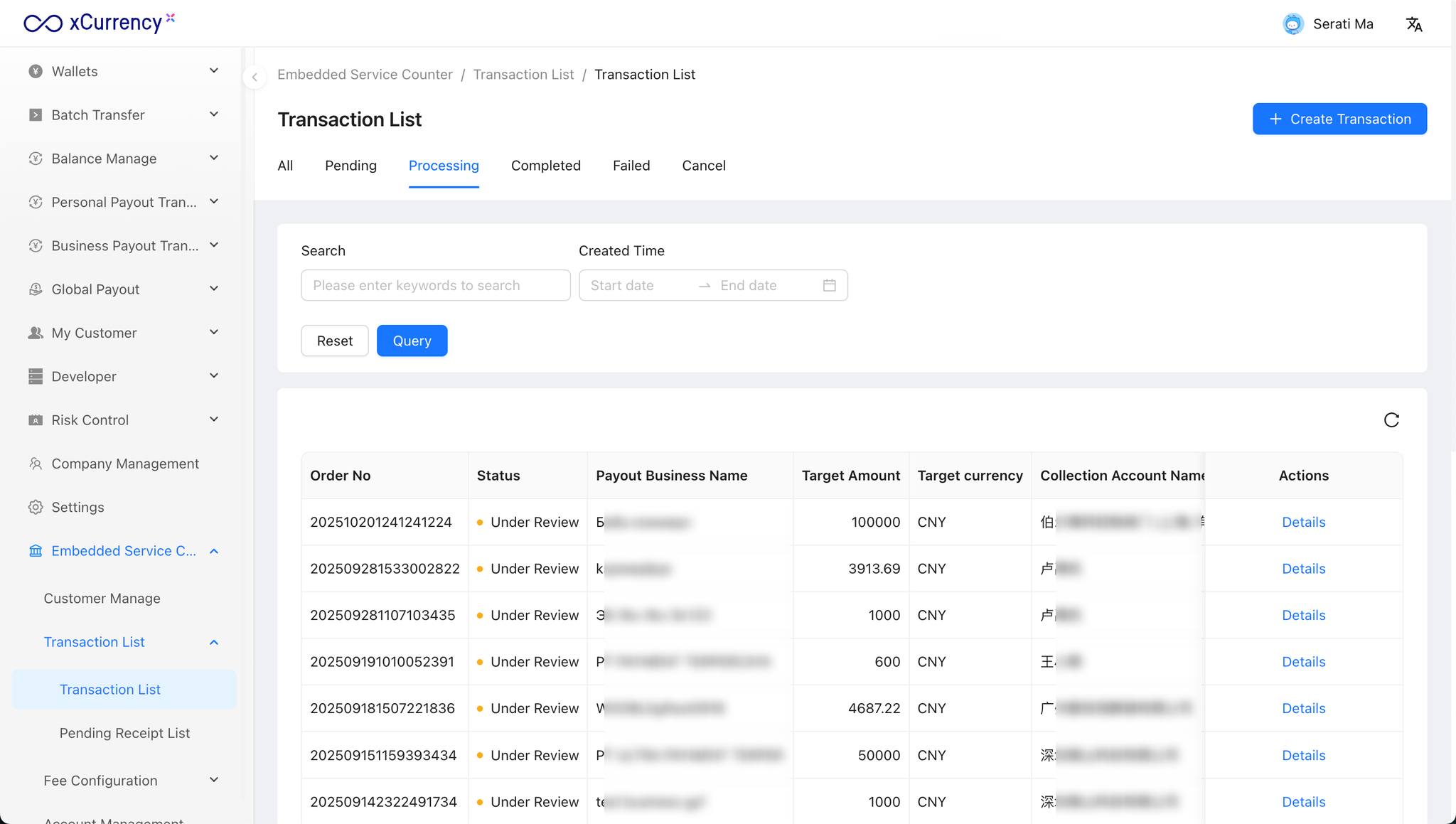

Order Review

After the institution confirms receipt, the order enters the compliance review process by JIJIAN Currency’s compliance operations team, who will verify authenticity and compliance.

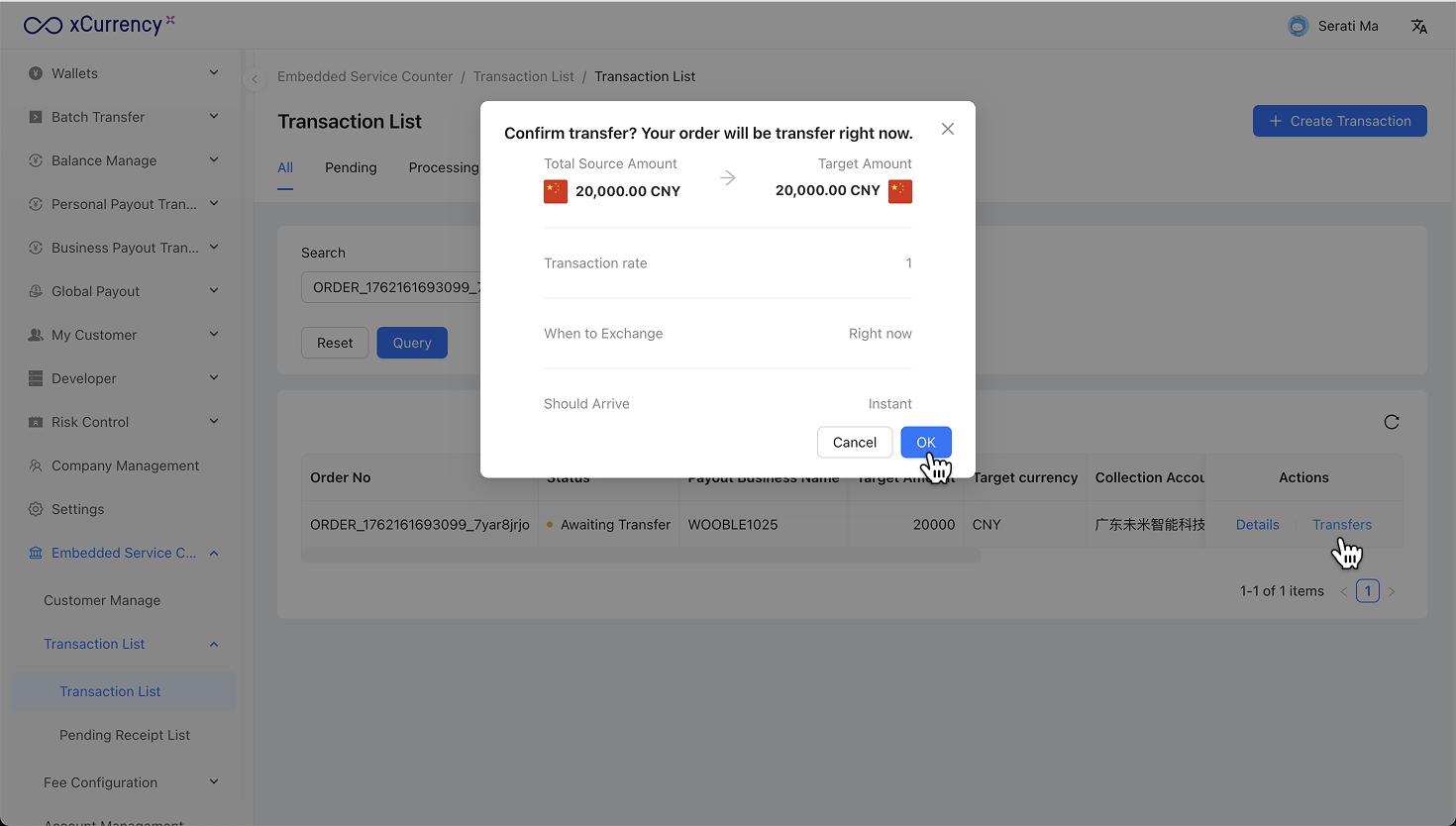

Fund Disbursement

After passing the review, the order awaits fund disbursement by the institution’s operations staff.

Clicking the Transfer button will trigger the cross-border disbursement process.

Order Status Description

Status | Description | Operation Guide |

Awaiting Remitter Payment | The payer has not yet completed payment. Usually occurs when the remitter chooses an online payment method but hasn’t finished the process. For offline payments (e.g., cash or transfer), the operator may manually confirm receipt.

| No system operation needed — wait for payment completion or manually confirm receipt.

|

Awaiting Receipt Confirmation | The remitter has paid funds to the institution’s account (via bank transfer, cash, or card) but has not yet been verified by the operator. | The institution must verify the deposit and click “Confirm Receipt” in the system. |

Under Review | After receipt confirmation, the order enters xCurrency Hubs compliance review, conducted by the compliance operations team for authenticity and compliance.

| Handled by xCurrency Hubs compliance team.

|

Awaiting Transfer | After approval, the order awaits disbursement by the institution’s operations staff. Clicking “Transfer” triggers the cross-border disbursement process. | The institution clicks “Transfer” to execute disbursement. |

Transferring | Funds are being transferred to the recipient’s account. The system interacts with the bank in real time to complete settlement. | System handles automatically — no manual action required.

|

Completed | The remittance process is fully completed, and the recipient has successfully received funds. | Status updates automatically — order closed.

|

Failed | The disbursement failed due to issues (e.g., bank return, compliance block, or channel error). The institution must contact xCurrency Hubs support for investigation. | The institution and xCurrency Hubs coordinate to retry or refund.

|

Cancelled | The order has been cancelled by the institution or system. The transaction process is terminated. | No further action. |